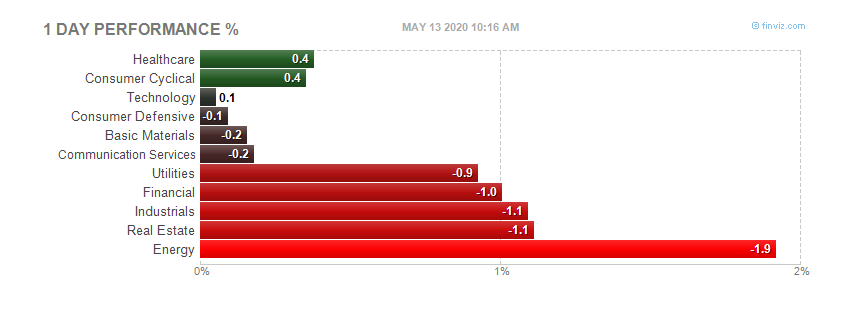

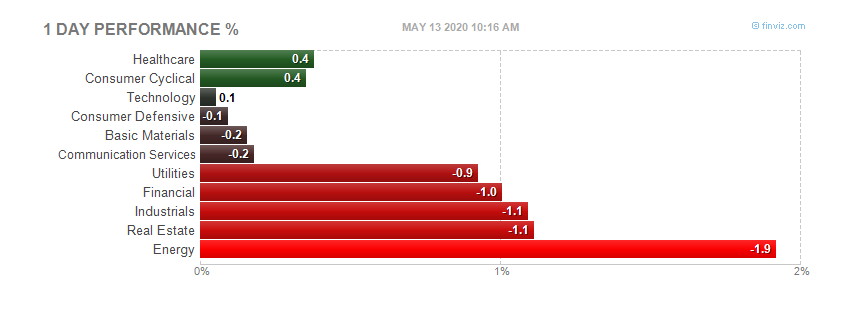

Today's heatmap:

Today's heatmap:

Daily information of the stock market.

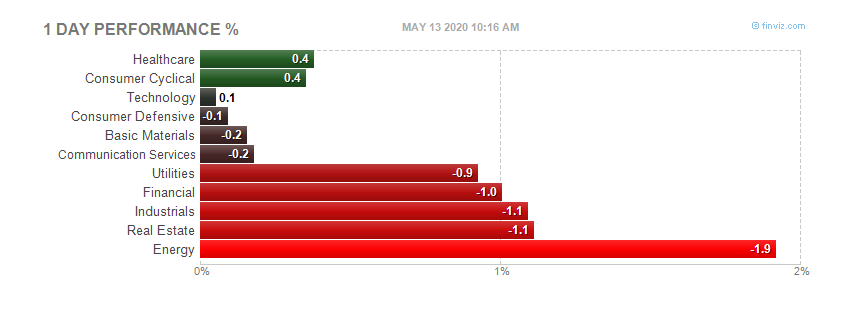

Today's heatmap:

Today's heatmap:

Today's heatmap:

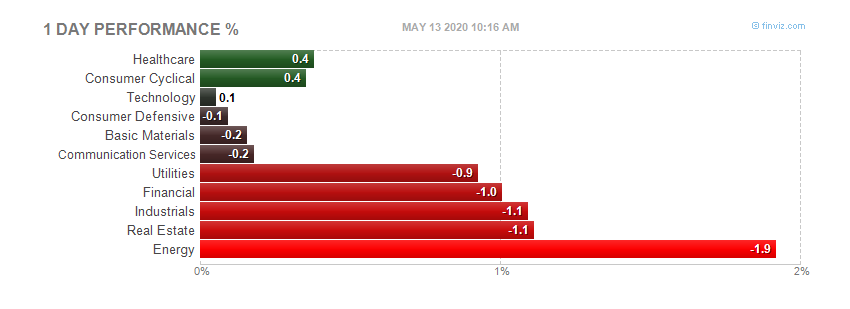

Today's heatmap:

Today's heatmap:

Today's heatmap:

Tomorrow's earnings before open:

CCL Carnival Corp. Services General Entertainment

DFS Discover Financial Services Financial Credit Services

FDX FedEx Corporation Services Air Delivery & Freight Services

MCS Marcus Corp. Services Lodging

PIR Pier 1 Imports Inc. Services Home Furnishing Stores

SMTS Somanetics Corp. Healthcare Medical Appliances & Equipment

Tomorrows earnings reports:

CMTL Comtech Telecommunications Corp. Technology Communication Equipment

IHS IHS Inc. Technology Business Software & Services

PALM Palm, Inc. Technology Personal Computers

PSEM Pericom Semiconductor Corp. Technology Semiconductor - Integrated Circuits

TSCM TheStreet.com, Inc. Technology Internet Information Providers

Tomorrow's earnings before open:

CCL Carnival Corp. Services General Entertainment

DFS Discover Financial Services Financial Credit Services

FDX FedEx Corporation Services Air Delivery & Freight Services

MCS Marcus Corp. Services Lodging

PIR Pier 1 Imports Inc. Services Home Furnishing Stores

SMTS Somanetics Corp. Healthcare Medical Appliances & Equipment

Tomorrows earnings reports:

CMTL Comtech Telecommunications Corp. Technology Communication Equipment

IHS IHS Inc. Technology Business Software & Services

PALM Palm, Inc. Technology Personal Computers

PSEM Pericom Semiconductor Corp. Technology Semiconductor - Integrated Circuits

TSCM TheStreet.com, Inc. Technology Internet Information Providers

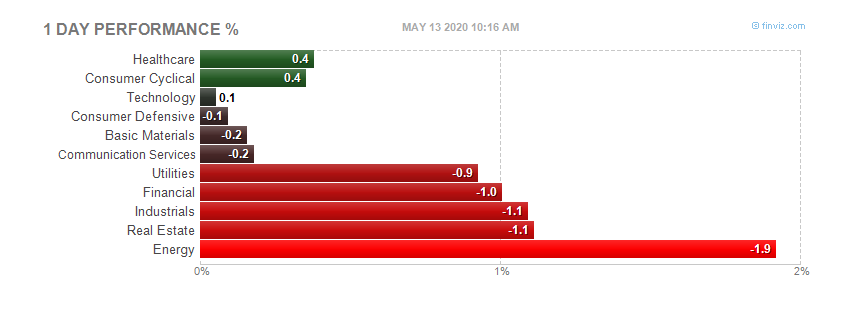

Today's heatmap:

Today's heatmap:

Earnings after close tonight:

ADBE Adobe Systems Inc. Technology Application Software

CGA China Green Agriculture, Inc. Basic Materials Agricultural Chemicals

Earnings reports before open tomorrow:

VOL Volt Information Sciences Inc. Services Staffing & Outsourcing Services

Earnings after close tonight:

ADBE Adobe Systems Inc. Technology Application Software

CGA China Green Agriculture, Inc. Basic Materials Agricultural Chemicals

Earnings reports before open tomorrow:

VOL Volt Information Sciences Inc. Services Staffing & Outsourcing Services

Full report here

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in September, following the upturn first observed in August. The general business conditions index increased 7 points, to 18.9, its highest level since late 2007. The new orders index was positive and higher than last month, while the shipments index dipped. The prices paid index rose several points to its highest level in many months, and the prices received index, while negative, inched close to zero. The index for number of employees remained in negative territory, while the average workweek index moved above zero for the first time in a year. Future indexes remained relatively high and close to their August levels, suggesting that conditions are expected to improve further in the months ahead. Indeed, the future general business conditions index reached its highest level in several years.

In response to a series of supplementary questions about past and prospective changes in the selling prices of their goods, manufacturers indicated that prices had declined by 2.1 percent, on average, over the past twelve months—a sharp contrast with the rise of 4.8 percent reported in an identical survey conducted a year ago (see supplemental report). Looking ahead to the next twelve months, respondents expected prices to rise by 1.9 percent, on average, compared with last year’s expected price rise of 3.6 percent. When asked about the probability of certain specified price changes over the next twelve months, the average respondent estimated a roughly 50 percent chance that prices would remain within 2 percent of their current levels, a 39 percent chance that they would rise 2 percent or more, and a 12 percent chance that they would drop 2 percent or more.

Conditions Improve for a Second Consecutive Month

In September, the general business conditions index posted its third consecutive monthly increase and its second consecutive positive reading. Rising 7 points to 18.9, the index was at its highest level since November 2007, with nearly 40 percent of respondents reporting that conditions had improved in September and 20 percent reporting that conditions had worsened. Similarly, the new orders index rose 6 points to 19.8, its highest level since November 2007. The shipments index dipped 9 points to 5.3; the unfilled orders index, while still below zero, rose to -4.8. The delivery time index moved above zero for the first time in considerably more than a year, climbing 12 points to 1.2. The inventories index remained well below zero, at -25.0.

Average Workweek Index Rises above Zero

The indexes for both prices paid and prices received advanced in September. The prices paid index rose 6 points to 20.2, its third consecutive positive reading—a sign that input prices were generally rising. The prices received index rose 9 points, but continued to be negative, at -3.6. The index for number of employees, at -8.3, remained negative and close to last month’s level. The average workweek index rose sharply, as it did last month, climbing 12 points to 6.0, its first positive reading in a year.

Continued Improvement Expected in the Months Ahead

Future indexes were generally positive and near last month’s levels. The future general business conditions index rose 4 points, to 52.3, a level last reached in 2004. The future new orders and shipments indexes held steady. The future inventories index dipped 11 points to -17.9. Future price indexes were both positive and higher than in August, and future employment indexes were also positive. The capital expenditures and technology spending indexes both edged down a few points, but remained positive.

Full report here

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in September, following the upturn first observed in August. The general business conditions index increased 7 points, to 18.9, its highest level since late 2007. The new orders index was positive and higher than last month, while the shipments index dipped. The prices paid index rose several points to its highest level in many months, and the prices received index, while negative, inched close to zero. The index for number of employees remained in negative territory, while the average workweek index moved above zero for the first time in a year. Future indexes remained relatively high and close to their August levels, suggesting that conditions are expected to improve further in the months ahead. Indeed, the future general business conditions index reached its highest level in several years.

In response to a series of supplementary questions about past and prospective changes in the selling prices of their goods, manufacturers indicated that prices had declined by 2.1 percent, on average, over the past twelve months—a sharp contrast with the rise of 4.8 percent reported in an identical survey conducted a year ago (see supplemental report). Looking ahead to the next twelve months, respondents expected prices to rise by 1.9 percent, on average, compared with last year’s expected price rise of 3.6 percent. When asked about the probability of certain specified price changes over the next twelve months, the average respondent estimated a roughly 50 percent chance that prices would remain within 2 percent of their current levels, a 39 percent chance that they would rise 2 percent or more, and a 12 percent chance that they would drop 2 percent or more.

Conditions Improve for a Second Consecutive Month

In September, the general business conditions index posted its third consecutive monthly increase and its second consecutive positive reading. Rising 7 points to 18.9, the index was at its highest level since November 2007, with nearly 40 percent of respondents reporting that conditions had improved in September and 20 percent reporting that conditions had worsened. Similarly, the new orders index rose 6 points to 19.8, its highest level since November 2007. The shipments index dipped 9 points to 5.3; the unfilled orders index, while still below zero, rose to -4.8. The delivery time index moved above zero for the first time in considerably more than a year, climbing 12 points to 1.2. The inventories index remained well below zero, at -25.0.

Average Workweek Index Rises above Zero

The indexes for both prices paid and prices received advanced in September. The prices paid index rose 6 points to 20.2, its third consecutive positive reading—a sign that input prices were generally rising. The prices received index rose 9 points, but continued to be negative, at -3.6. The index for number of employees, at -8.3, remained negative and close to last month’s level. The average workweek index rose sharply, as it did last month, climbing 12 points to 6.0, its first positive reading in a year.

Continued Improvement Expected in the Months Ahead

Future indexes were generally positive and near last month’s levels. The future general business conditions index rose 4 points, to 52.3, a level last reached in 2004. The future new orders and shipments indexes held steady. The future inventories index dipped 11 points to -17.9. Future price indexes were both positive and higher than in August, and future employment indexes were also positive. The capital expenditures and technology spending indexes both edged down a few points, but remained positive.

Today's heatmap:

Today's heatmap: