Link to article here.

U.S. housing misery poised to enter new phase

U.S. housing misery poised to enter new phase

Fri Jun 26, 2009 1:25pm EDT

By Herbert Lash - Analysis

NEW YORK (Reuters) - Signs that home prices may have bottomed have stirred hope on Wall Street that the economy is on the mend, yet tight credit and a new foreclosure wave cast doubt on any looming housing revival.

Sales of previously owned U.S. homes rose for a second straight month in May, realty data on Tuesday showed, while the U.S. government and Federal Reserve have designed a number of programs to alleviate a battered housing market.

However, the chief economist of the National Association of Realtors warned of the danger of a "delayed" recovery in housing, with prices down 32 percent nationwide from their peak three years ago.

Big risk factors that could spur more foreclosures include expectations of rising unemployment and the forecast resetting of interest rates on

2.8 million subprime and Alt-A mortgages in the next two years.

Delinquency rates on mortgage payments typically rise in tandem with unemployment, which is expected to top 10 percent after hitting a 25-year high of 9.4 percent in May. And when mortgages interest rates reset, they are typically at higher rates that can cause monthly payments to balloon.

"I'm worried that the investment community is a little too sanguine about how much of the housing pain is behind us and that we might be in the all-clear," said Ronald Temple, co-director of research at Lazard Asset Management in New York.

Against this backdrop comes continuing tightness in housing credit. According to Amherst Securities Group LP, a severe lack of credit outside of government-sponsored mortgages has reduced loans, especially for the purchase of new homes, and is putting further downward pressure on prices.

Authorities are aware of the hurdles housing poses to economic recovery. The U.S. government is trying to stabilize housing by offering incentives for lenders to favorably modify the terms of delinquent mortgages. And the Federal Reserve has pledged to buy as much as $1.25 trillion in mortgage-backed securities to free up funding for new home loans.

FORECLOSURES HITTING THE MORE CREDIT-WORTHY

One in eight U.S. households at the end of March had entered foreclosure or was delinquent on payments, the Mortgage Bankers Association (MBA) said last month.

The number of homes in foreclosure in the first quarter jumped to a record 3.85 percent of outstanding U.S. mortgages, MBA said.

The bulk of recent foreclosures was on prime, fixed-rate loans, extended to the most credit-worthy borrowers and the bedrock of home ownership in America.

The first wave of foreclosures had been mostly on subprime loans offered to the riskiest borrowers.

The foreclosure rate is getting worse and will likely rise to about 4.5 percent, said Patrick Newport, an economist at IHS in Lexington, Massachusetts who closely follows housing.

"What's driving people to leave their homes is a combination of having their house under water and then losing their job," Newport said. "Under water," or negative equity, refers to when the market value of a home is less than the mortgage.

"We're in this vicious cycle and there are no signs that we're getting out of it," Newport said.

Another wave of defaults, this one associated with Alt-A loans, is building.

While Alt-A borrowers in general were more credit-worthy, they included self-documented income histories, which may be problematic, and loans that need to be recast or redone, said Mark Fleming, chief economist at First American CoreLogic.

About 812,000 adjustable-rate mortgages, or 11 percent, have already had their interest rates reset, according to Loan Performance, a unit of First American CoreLogic Inc, a leading provider of real estate and property information.

Compounding the problem for loans facing rate resets is that the potential for negative equity has increased as home prices have fallen more.

"These homeowners are having this issue of resets in an environment where the economic stress is higher, and the cumulative effect of house price declines is higher," Fleming said.

LIMITED CREDIT SQUEEZING HOUSING MARKET

In addition, while analysts and the press have focused on foreclosures and unemployment, the lack of mortgage credit has "received significantly less attention than it deserves" and instead of being addressed, continues to deteriorate, according to Amherst.

Government-sponsored lending, known as agency debt, soared to account for more than 98 percent of U.S. residential loans in the first quarter. That is a dramatic surge from 2005 and 2006 -- the height of the housing boom -- when it was less than 50 percent, according to data that Amherst compiled from Inside MBS & ABS, Loan Performance and its own information.

Mortgage debt held in bank portfolios has dropped, while issuance of subprime and Alt-A loans, the latter accounting for $1 trillion in mortgage issuance in both 2005 and 2006, has plunged. Only $64 billion was issued in that space last year.

While agency activity has picked up considerably, most of that has been for refinancing existing loans, leaving very little credit for new home loans, Amherst said.

New lending has been minimal and one reason for declining home prices is that mortgage credit is very tight, Amherst said.

And declining prices could spell more trouble in the future.

The average U.S. household at the end of March held only 8 percent equity in their home, Temple said. A 20 percent slide in home prices could lead in two years to more than 30 million people who owe more than their homes are worth, he said.

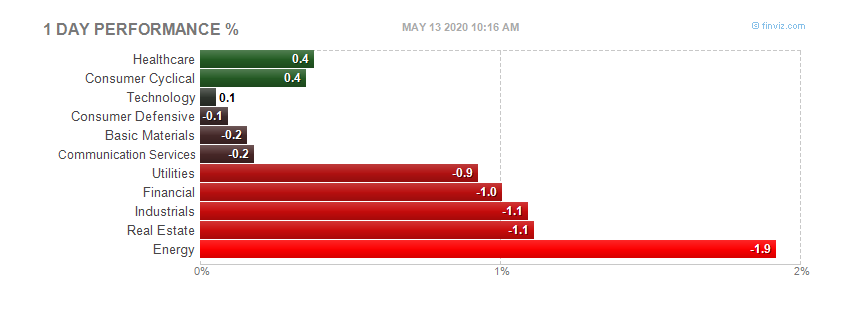

Today's heatmap:

Today's heatmap:

I'm not a technician, but that looks like a pretty nice head and shoulders. We have yet to find out of course. Earnings season is right around the corner, and next week we have some bond auctions that might be interesting. The economic news is not very good with a few exceptions. Less bad, not as bad as expected, contracting slower, and green shoots have been the buzzwords. The chart is suggesting a bearish tone. I think we may want to watch that chart. Green shoots might turn into weeds.

I'm not a technician, but that looks like a pretty nice head and shoulders. We have yet to find out of course. Earnings season is right around the corner, and next week we have some bond auctions that might be interesting. The economic news is not very good with a few exceptions. Less bad, not as bad as expected, contracting slower, and green shoots have been the buzzwords. The chart is suggesting a bearish tone. I think we may want to watch that chart. Green shoots might turn into weeds.