Daily information of the stock market.

* Non-Manufacturing ISM Report On Business® data is seasonally adjusted for Business Activity, New Orders, Prices and Employment. Manufacturing ISM Report On Business® data is seasonally adjusted for New Orders, Production, Employment, Supplier Deliveries and Inventories.

** Number of months moving in current direction.

COMMODITIES REPORTED UP / DOWN IN PRICE, and IN SHORT SUPPLY

Commodities Up in Price

Beef; Cheese (4); Diesel Fuel; #1 Diesel Fuel; #2 Diesel Fuel; Fuel (2); Gasoline; Laboratory Equipment; Masks [for TB/H1N1 use] (2); and Pharmacy Supplies.

Commodities Down in Price

Alloys (2); and Carbon Pipe.

Commodities in Short Supply

Masks [for TB/H1N1 use] (2) is the only commodity reported in short supply.

Note: The number of consecutive months the commodity is listed is indicated after each item.

* Non-Manufacturing ISM Report On Business® data is seasonally adjusted for Business Activity, New Orders, Prices and Employment. Manufacturing ISM Report On Business® data is seasonally adjusted for New Orders, Production, Employment, Supplier Deliveries and Inventories.

** Number of months moving in current direction.

COMMODITIES REPORTED UP / DOWN IN PRICE, and IN SHORT SUPPLY

Commodities Up in Price

Beef; Cheese (4); Diesel Fuel; #1 Diesel Fuel; #2 Diesel Fuel; Fuel (2); Gasoline; Laboratory Equipment; Masks [for TB/H1N1 use] (2); and Pharmacy Supplies.

Commodities Down in Price

Alloys (2); and Carbon Pipe.

Commodities in Short Supply

Masks [for TB/H1N1 use] (2) is the only commodity reported in short supply.

Note: The number of consecutive months the commodity is listed is indicated after each item.

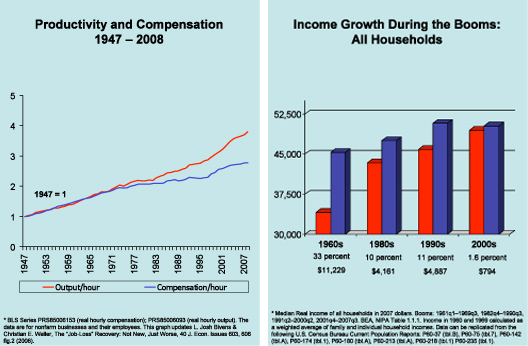

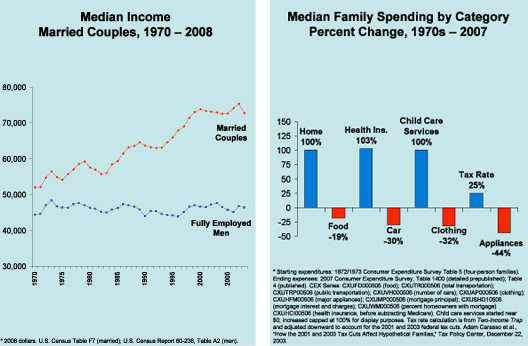

But core expenses kept going up. By the early 2000s, families were spending twice as much (adjusted for inflation) on mortgages than they did a generation ago -- for a house that was, on average, only ten percent bigger and 25 years older. They also had to pay twice as much to hang on to their health insurance.

To cope, millions of families put a second parent into the workforce. But higher housing and medical costs combined with new expenses for child care, the costs of a second car to get to work and higher taxes combined to squeeze families even harder. Even with two incomes, they tightened their belts. Families today spend less than they did a generation ago on food, clothing, furniture, appliances, and other flexible purchases -- but it hasn't been enough to save them. Today's families have spent all their income, have spent all their savings, and have gone into debt to pay for college, to cover serious medical problems, and just to stay afloat a little while longer.

But core expenses kept going up. By the early 2000s, families were spending twice as much (adjusted for inflation) on mortgages than they did a generation ago -- for a house that was, on average, only ten percent bigger and 25 years older. They also had to pay twice as much to hang on to their health insurance.

To cope, millions of families put a second parent into the workforce. But higher housing and medical costs combined with new expenses for child care, the costs of a second car to get to work and higher taxes combined to squeeze families even harder. Even with two incomes, they tightened their belts. Families today spend less than they did a generation ago on food, clothing, furniture, appliances, and other flexible purchases -- but it hasn't been enough to save them. Today's families have spent all their income, have spent all their savings, and have gone into debt to pay for college, to cover serious medical problems, and just to stay afloat a little while longer.

Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families.

The contrast with the big banks could not be sharper. While the middle class has been caught in an economic vise, the financial industry that was supposed to serve them has prospered at their expense. Consumer banking -- selling debt to middle class families -- has been a gold mine. Boring banking has given way to creative banking, and the industry has generated tens of billions of dollars annually in fees made possible by deceptive and dangerous terms buried in the fine print of opaque, incomprehensible, and largely unregulated contracts.

And when various forms of this creative banking triggered economic crisis, the banks went to Washington for a handout. All the while, top executives kept their jobs and retained their bonuses. Even though the tax dollars that supported the bailout came largely from middle class families -- from people already working hard to make ends meet -- the beneficiaries of those tax dollars are now lobbying Congress to preserve the rules that had let those huge banks feast off the middle class.

Pundits talk about "populist rage" as a way to trivialize the anger and fear coursing through the middle class. But they have it wrong. Families understand with crystalline clarity that the rules they have played by are not the same rules that govern Wall Street. They understand that no American family is "too big to fail." They recognize that business models have shifted and that big banks are pulling out all the stops to squeeze families and boost revenues. They understand that their economic security is under assault and that leaving consumer debt effectively unregulated does not work.

Families are ready for change. According to polls, large majorities of Americans have welcomed the Obama Administration's proposal for a new Consumer Financial Protection Agency (CFPA). The CFPA would be answerable to consumers -- not to banks and not to Wall Street. The agency would have the power to end tricks-and-traps pricing and to start leveling the playing field so that consumers have the tools they need to compare prices and manage their money. The response of the big banks has been to swing into action against the Agency, fighting with all their lobbying might to keep business-as-usual. They are pulling out all the stops to kill the agency before it is born. And if those practices crush millions more families, who cares -- so long as the profits stay high and the bonuses keep coming.

America today has plenty of rich and super-rich. But it has far more families who did all the right things, but who still have no real security. Going to college and finding a good job no longer guarantee economic safety. Paying for a child's education and setting aside enough for a decent retirement have become distant dreams. Tens of millions of once-secure middle class families now live paycheck to paycheck, watching as their debts pile up and worrying about whether a pink slip or a bad diagnosis will send them hurtling over an economic cliff.

America without a strong middle class? Unthinkable, but the once-solid foundation is shaking.

Elizabeth Warren is the Leo Gottlieb Professor of Law at Harvard and is currently the Chair of the Congressional Oversight Panel.

Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families.

The contrast with the big banks could not be sharper. While the middle class has been caught in an economic vise, the financial industry that was supposed to serve them has prospered at their expense. Consumer banking -- selling debt to middle class families -- has been a gold mine. Boring banking has given way to creative banking, and the industry has generated tens of billions of dollars annually in fees made possible by deceptive and dangerous terms buried in the fine print of opaque, incomprehensible, and largely unregulated contracts.

And when various forms of this creative banking triggered economic crisis, the banks went to Washington for a handout. All the while, top executives kept their jobs and retained their bonuses. Even though the tax dollars that supported the bailout came largely from middle class families -- from people already working hard to make ends meet -- the beneficiaries of those tax dollars are now lobbying Congress to preserve the rules that had let those huge banks feast off the middle class.

Pundits talk about "populist rage" as a way to trivialize the anger and fear coursing through the middle class. But they have it wrong. Families understand with crystalline clarity that the rules they have played by are not the same rules that govern Wall Street. They understand that no American family is "too big to fail." They recognize that business models have shifted and that big banks are pulling out all the stops to squeeze families and boost revenues. They understand that their economic security is under assault and that leaving consumer debt effectively unregulated does not work.

Families are ready for change. According to polls, large majorities of Americans have welcomed the Obama Administration's proposal for a new Consumer Financial Protection Agency (CFPA). The CFPA would be answerable to consumers -- not to banks and not to Wall Street. The agency would have the power to end tricks-and-traps pricing and to start leveling the playing field so that consumers have the tools they need to compare prices and manage their money. The response of the big banks has been to swing into action against the Agency, fighting with all their lobbying might to keep business-as-usual. They are pulling out all the stops to kill the agency before it is born. And if those practices crush millions more families, who cares -- so long as the profits stay high and the bonuses keep coming.

America today has plenty of rich and super-rich. But it has far more families who did all the right things, but who still have no real security. Going to college and finding a good job no longer guarantee economic safety. Paying for a child's education and setting aside enough for a decent retirement have become distant dreams. Tens of millions of once-secure middle class families now live paycheck to paycheck, watching as their debts pile up and worrying about whether a pink slip or a bad diagnosis will send them hurtling over an economic cliff.

America without a strong middle class? Unthinkable, but the once-solid foundation is shaking.

Elizabeth Warren is the Leo Gottlieb Professor of Law at Harvard and is currently the Chair of the Congressional Oversight Panel.

COMMODITIES REPORTED UP/DOWN IN PRICE and IN SHORT SUPPLY

Commodities Up in Price

Aluminum (5); Copper (6); Copper Based Products (5); Natural Gas (2); Oil; and Steel (5).

Commodities Down in Price

No commodities are reported down in price.

Commodities in Short Supply

Electronic Components is the only commodity reported in short supply.

Note: The number of consecutive months the commodity is listed is indicated after each item.

PMI

Manufacturing growth decelerated in November as the PMI registered 53.6 percent, a decrease of 2.1 percentage points when compared to October's reading of 55.7 percent. This continues the recovery in the sector, but at a slower rate of growth. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

A PMI in excess of 41.2 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the PMI indicates growth for the seventh consecutive month in the overall economy, as well as expansion in the manufacturing sector for the fourth consecutive month. Ore stated, "The past relationship between the PMI and the overall economy indicates that the average PMI for January through November (45.4 percent) corresponds to a 1.3 percent increase in real gross domestic product (GDP). However, if the PMI for November (53.6 percent) is annualized, it corresponds to a 3.9 percent increase in real GDP annually."

THE LAST 12 MONTHS

COMMODITIES REPORTED UP/DOWN IN PRICE and IN SHORT SUPPLY

Commodities Up in Price

Aluminum (5); Copper (6); Copper Based Products (5); Natural Gas (2); Oil; and Steel (5).

Commodities Down in Price

No commodities are reported down in price.

Commodities in Short Supply

Electronic Components is the only commodity reported in short supply.

Note: The number of consecutive months the commodity is listed is indicated after each item.

PMI

Manufacturing growth decelerated in November as the PMI registered 53.6 percent, a decrease of 2.1 percentage points when compared to October's reading of 55.7 percent. This continues the recovery in the sector, but at a slower rate of growth. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

A PMI in excess of 41.2 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the PMI indicates growth for the seventh consecutive month in the overall economy, as well as expansion in the manufacturing sector for the fourth consecutive month. Ore stated, "The past relationship between the PMI and the overall economy indicates that the average PMI for January through November (45.4 percent) corresponds to a 1.3 percent increase in real gross domestic product (GDP). However, if the PMI for November (53.6 percent) is annualized, it corresponds to a 3.9 percent increase in real GDP annually."

THE LAST 12 MONTHS

Highlights

* The Chicago PMI index jumped over the 50 point threshold for the first time since September 2008 as the index grew to 54.2 in October. The consensus expected the index to increase slightly to 49.0 from 46.1 and remain in the contraction phase.

* The production index increased to 63.9 from 47.2 and orders rose to 61.4 from 46.3.

* Inventories continued to contract and have gotten worse over the last month as the index declined to 32.2 from 38.9.

* The only other sector that continued to contract was employment, which declined to 38.3 from 38.8.

* Other components of the index showed the manufacturing sector strengthening including order backlogs, which increased to 41.9 from 36.7 and prices paid, which declined to 48.6 from 51.3.

Key Factors

* The entire index showed signs of a sustainable expansionary cycle.

* Unlike last month's national index, where production grew on the anticipation of new orders that never came in, production and new orders posted strong growth and entered an expansionary phase in the Chicago region.

Big Picture

* The Chicago PMI has little overall economic value, and is only watched by the financial markets because it is usually released one day in advance of the similar national ISM manufacturing survey. A significant move in this regional survey will therefore sometimes be seen as having predictive value for the ISM index.

Highlights

* The Chicago PMI index jumped over the 50 point threshold for the first time since September 2008 as the index grew to 54.2 in October. The consensus expected the index to increase slightly to 49.0 from 46.1 and remain in the contraction phase.

* The production index increased to 63.9 from 47.2 and orders rose to 61.4 from 46.3.

* Inventories continued to contract and have gotten worse over the last month as the index declined to 32.2 from 38.9.

* The only other sector that continued to contract was employment, which declined to 38.3 from 38.8.

* Other components of the index showed the manufacturing sector strengthening including order backlogs, which increased to 41.9 from 36.7 and prices paid, which declined to 48.6 from 51.3.

Key Factors

* The entire index showed signs of a sustainable expansionary cycle.

* Unlike last month's national index, where production grew on the anticipation of new orders that never came in, production and new orders posted strong growth and entered an expansionary phase in the Chicago region.

Big Picture

* The Chicago PMI has little overall economic value, and is only watched by the financial markets because it is usually released one day in advance of the similar national ISM manufacturing survey. A significant move in this regional survey will therefore sometimes be seen as having predictive value for the ISM index.