Thursday, December 31, 2015

Tuesday, December 29, 2015

Thursday, December 24, 2015

Tuesday, December 22, 2015

Monday, December 21, 2015

Thursday, December 17, 2015

Wednesday, December 16, 2015

Thursday, December 10, 2015

Wednesday, December 9, 2015

Tuesday, December 8, 2015

Charles Hugh Smith, John Maynard Keynes

The Fallacy that Weakening Your Currency Generates Prosperity

"By a continuing process of inflation governments can

confiscate, secretly and unobserved, an important part of the wealth of their

citizens. By this method they not only confiscate, but they confiscate

arbitrarily; and, while the process impoverishes many, it actually enriches

some. The sight of this arbitrary rearrangement of riches strikes not only at

security, but at confidence in the equity of the existing distribution of

wealth

Those to whom the system brings windfalls, beyond their

deserts and even beyond their expectations or desires, become 'profiteers,' who

are the object of the hatred of the bourgeoisie, whom the inflationism has

impoverished, not less than of the proletariat. As the inflation proceeds and

the real value of the currency fluctuates wildly from month to month, all

permanent relations between debtors and creditors, which form the ultimate

foundation of capitalism, become so utterly disordered as to be almost

meaningless; and the process of wealth-getting degenerates into a gamble and a

lottery.

Lenin was certainly right. There is no subtler, no surer

means of overturning the existing basis of society than to debauch the

currency. The process engages all the hidden forces of economic law on the side

of destruction, and does it in a manner which not one man in a million is able

to diagnose."

John Maynard Keynes

Monday, December 7, 2015

Monday, November 30, 2015

Saturday, November 21, 2015

Monday, November 16, 2015

Monday, October 26, 2015

Friday, October 23, 2015

Monday, October 19, 2015

Friday, October 16, 2015

Wednesday, October 14, 2015

Tuesday, October 13, 2015

Friday, October 9, 2015

Wednesday, October 7, 2015

Monday, October 5, 2015

Friday, October 2, 2015

Wednesday, September 23, 2015

Monday, September 21, 2015

Friday, September 18, 2015

Saturday, September 12, 2015

Thursday, September 10, 2015

we need more demand to get more jobs. If

income were better distributed, it would generate more demand at the

same GDP. The growth we are getting does not generate demand.

I haven't went on a rant for a while. You have used some key buzzwords here that make me want to go on one. The following is not directed at you, as much it's against the buzzwords you have used, although I will circle around and address the statement as well.

***

I want to address the word demand, which has cropped up lately (in this thread or another, not sure). Demand; as in demand-side economics. What exactly is that? From Investopedia;

The bold and * & ** are mine. Let's address the single * first.

The above line is pretty much this;

Well, not pretty much, it's exactly it. That is the GDP calculation the Bureau of Economic Analysis reports every quarter, and this particular piece of data is treated as the "bible" as far a economic growth is measured.

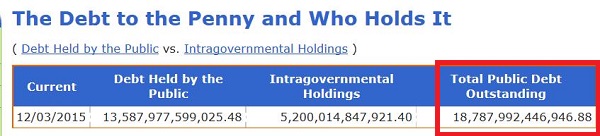

As the equation shows, the "G" is government spending. Government spending is really borrowing money because we are broke (-18,151,085,083,623.06 in the red as we speak). So .gov decides to borrow money and pump it into the economy so it gets spent - this creates demand, therefore jobs, and "the pump gets primed" for economic liftoff. A rise in the GDP proves it, because that's how it is measured.

Some think we need to do more; debt is good and all that (hint; the democratic socialists are one of the culprits, but many of the plutocrats and their mouthpieces do too).

YET!

Since the GFC (great financial crisis (I went with 1-1-2008 as a start)) to present, the United States debt has grown from 9.2 trillon to 18.2 trillion (based on the same "public debt outstanding" which is reported to the penny, daily, by the Treasury dept (my above debt number)). Because debt = money, this 9 trillion finds it's way to "G" in the GDP calculation.

Historical data at this link (from the Treasury); historical debt data from January 1 2008 to present.

Let's see, 2008 - 2015(6). The debt doubled in 8 years. But I digress...

On top of the debt (spending) interest rates have been pegged to zero (for some - everyone raise their hands who gets zero interest on borrowed money) for 6 1/2 years. Booyah! Which is really MORE stimulus in the attempt to kick start the "green shoots" of economic growth.

How we doin'?

The central planners of the world have thrown the kitchen sink at "Main Street (so they say)" and we still have anemic economic growth; measured by GDP, defined as we know it. We can further discuss "demand side", which leads into "Say's Law" and then "marginal propensity" and all that other Keynesian theory of economics the bought and paid for academic hucksters like Krugman, Mankiw, and Hubbard write books about. But I don't.

The keyword here is theory.

Money doesn't care about theories, nor do the markets, which is a segue into the **.

Demand side economics claims that economic activity is best boosted by increasing the buying power of the lower and middle classes, thus increasing the demand for goods and services.

Buying power. That is the same thing as "purchasing power." Keynesian heads are exploding, I know.

When you expand the money supply (via debt), which we have taken to an entirely new level (by juicing the "G" component of GDP), the value of our currency is devalued - this creates the complete opposite of "increasing" buying power. This is an indisputable fact - the financial markets prove it day in and day out. This is how money works, plain and simple.

Theories are only that - a theory. This one (Keynesian money printing) don't work. That should be a slam dunk (proven by now); insanity defined. Neither does the "trickle down" dreamed up by the Reagan administration, admitted to by David Stockman himself, who was the director of Reagan's OMB at the time. But back to today.

Take away the 9 trillion we spent (since 2008) from that equation, we have GDP numbers that puts us in not only a recession (I know, the financial wizards said we were out of recession years ago), but a depression. Take away the SNAP cards (anti-riot control devices) and we have bread lines that resemble the Great Depression.

Growth? You want growth? Redistribute income to generate more demand at the same GDP? That won't make a lick of mathematical sense to the plutocrats as the GDP number won't go up. It's only rearranging the deck chairs on the Titanic. The only thing that raises GDP numbers (growth) is more .gov debt because we can't grow on our own (the C, I, and X components). We can't? Why?

Peak debt.

The above graph is non-government debt (C & I components). Notice the huge curve upward from before 1990 to 2008. That rocket shot is fueled by non-government debt. It hasn't and won't recover any time soon. The C & I contribution to GDP is flat or anemic at best. We are tapped out and can't borrow more money, or we don't want to.

The only way to make GDP go up, is to inject more money. The mechanisms in which the money (stimulus some call it) makes its way through the economy starts with the primary market, which is Wall Street and the Fed (the mechanism to monetize government debt) because any injections of money (debt) starts there. They get the money first.

The money never gets to us (some even call it the trickle down effect). That's a feature, not a bug.

The highest paid people on Wall Street are their traders, not the ivory tower academic bullshiters who write the books the sell side hucksters (analysts) use to rape the Muppets (us). They don't give one good **** about Keynesian/Von Mises/trickle down economic "theories."

The Traders know how money and the mechanisms of the market works. They also know how to take advantage of it, and they especially love the vast amounts of money the central planners create, so they can use to leverage into even more money. Booyah again! A traders wet dream, and a quite profitable one at that.

While the traders abuse the Muppets, the central planners will keep "priming the pump" (see the EU, Japan, and now China as other examples) and tell us this will "boost the economy" or "create growth" or some other crap they feed us.

The plutocrats who get at the money first (via their traders on Wall Street), are able to take advantage of the huge bubbles blown by the mass injections of liquidity. They are getting richer, while the serfs (us) continue to get squeezed because the price of goods and services will continue to go up due to the insane policy (theory) of expanding the money/credit supply.

We simply can't keep up.

Our monetary system is a giant Ponzi scheme, ran for the benefit of the Plutocrats, by the Plutocrats.

tl:dr

FUBAR

I haven't went on a rant for a while. You have used some key buzzwords here that make me want to go on one. The following is not directed at you, as much it's against the buzzwords you have used, although I will circle around and address the statement as well.

I want to address the word demand, which has cropped up lately (in this thread or another, not sure). Demand; as in demand-side economics. What exactly is that? From Investopedia;

A: Demand side economics is based on the belief that the main force affecting overall economic activity and causing short-term fluctuations is consumer demand for goods and services. Sometimes called Demand side economics, demand side economics developed in response to the Great Depression when conventional supply side economics failed to adequately explain why the mechanisms of the free market was seemingly unable to self-correct or restore balance to the economy as previously expected.

In opposition to classical theories of economics that theorize economic activity is stimulated by increasing net wealth, leading to investment in providing increased supplies. Demand side economics claims that economic activity is best boosted by increasing the buying power of the lower and middle classes, thus increasing the demand for goods and services.**

At the core of demand side economics is the focus on Aggregate Demand. Aggregate demand is the combination of consumption of goods, industry investment in capital goods, government spending and net exports.* When other elements of aggregate demand are weak, the government can mitigate their impact by increasing its spending. The government can intervene to generate demand for goods and services.

Demand side economists support heavy government spending during a national recession to overcome the short-term low aggregate demand. Raising the market's aggregate demand will reduce unemployment and encourage economic activity, according to this theory. The government increases demand through spending on public goods and services as well as through its control of the money supply through altering interest rates or trading on government-issued bonds.

The bold and * & ** are mine. Let's address the single * first.

Aggregate demand is the combination of consumption of goods, industry investment in capital goods, government spending and net exports.

The above line is pretty much this;

Well, not pretty much, it's exactly it. That is the GDP calculation the Bureau of Economic Analysis reports every quarter, and this particular piece of data is treated as the "bible" as far a economic growth is measured.

As the equation shows, the "G" is government spending. Government spending is really borrowing money because we are broke (-18,151,085,083,623.06 in the red as we speak). So .gov decides to borrow money and pump it into the economy so it gets spent - this creates demand, therefore jobs, and "the pump gets primed" for economic liftoff. A rise in the GDP proves it, because that's how it is measured.

Some think we need to do more; debt is good and all that (hint; the democratic socialists are one of the culprits, but many of the plutocrats and their mouthpieces do too).

YET!

Since the GFC (great financial crisis (I went with 1-1-2008 as a start)) to present, the United States debt has grown from 9.2 trillon to 18.2 trillion (based on the same "public debt outstanding" which is reported to the penny, daily, by the Treasury dept (my above debt number)). Because debt = money, this 9 trillion finds it's way to "G" in the GDP calculation.

Historical data at this link (from the Treasury); historical debt data from January 1 2008 to present.

Let's see, 2008 - 2015(6). The debt doubled in 8 years. But I digress...

On top of the debt (spending) interest rates have been pegged to zero (for some - everyone raise their hands who gets zero interest on borrowed money) for 6 1/2 years. Booyah! Which is really MORE stimulus in the attempt to kick start the "green shoots" of economic growth.

How we doin'?

The central planners of the world have thrown the kitchen sink at "Main Street (so they say)" and we still have anemic economic growth; measured by GDP, defined as we know it. We can further discuss "demand side", which leads into "Say's Law" and then "marginal propensity" and all that other Keynesian theory of economics the bought and paid for academic hucksters like Krugman, Mankiw, and Hubbard write books about. But I don't.

The keyword here is theory.

Money doesn't care about theories, nor do the markets, which is a segue into the **.

Demand side economics claims that economic activity is best boosted by increasing the buying power of the lower and middle classes, thus increasing the demand for goods and services.

Buying power. That is the same thing as "purchasing power." Keynesian heads are exploding, I know.

When you expand the money supply (via debt), which we have taken to an entirely new level (by juicing the "G" component of GDP), the value of our currency is devalued - this creates the complete opposite of "increasing" buying power. This is an indisputable fact - the financial markets prove it day in and day out. This is how money works, plain and simple.

Theories are only that - a theory. This one (Keynesian money printing) don't work. That should be a slam dunk (proven by now); insanity defined. Neither does the "trickle down" dreamed up by the Reagan administration, admitted to by David Stockman himself, who was the director of Reagan's OMB at the time. But back to today.

Take away the 9 trillion we spent (since 2008) from that equation, we have GDP numbers that puts us in not only a recession (I know, the financial wizards said we were out of recession years ago), but a depression. Take away the SNAP cards (anti-riot control devices) and we have bread lines that resemble the Great Depression.

Growth? You want growth? Redistribute income to generate more demand at the same GDP? That won't make a lick of mathematical sense to the plutocrats as the GDP number won't go up. It's only rearranging the deck chairs on the Titanic. The only thing that raises GDP numbers (growth) is more .gov debt because we can't grow on our own (the C, I, and X components). We can't? Why?

Peak debt.

The above graph is non-government debt (C & I components). Notice the huge curve upward from before 1990 to 2008. That rocket shot is fueled by non-government debt. It hasn't and won't recover any time soon. The C & I contribution to GDP is flat or anemic at best. We are tapped out and can't borrow more money, or we don't want to.

The only way to make GDP go up, is to inject more money. The mechanisms in which the money (stimulus some call it) makes its way through the economy starts with the primary market, which is Wall Street and the Fed (the mechanism to monetize government debt) because any injections of money (debt) starts there. They get the money first.

The money never gets to us (some even call it the trickle down effect). That's a feature, not a bug.

The highest paid people on Wall Street are their traders, not the ivory tower academic bullshiters who write the books the sell side hucksters (analysts) use to rape the Muppets (us). They don't give one good **** about Keynesian/Von Mises/trickle down economic "theories."

The Traders know how money and the mechanisms of the market works. They also know how to take advantage of it, and they especially love the vast amounts of money the central planners create, so they can use to leverage into even more money. Booyah again! A traders wet dream, and a quite profitable one at that.

While the traders abuse the Muppets, the central planners will keep "priming the pump" (see the EU, Japan, and now China as other examples) and tell us this will "boost the economy" or "create growth" or some other crap they feed us.

The plutocrats who get at the money first (via their traders on Wall Street), are able to take advantage of the huge bubbles blown by the mass injections of liquidity. They are getting richer, while the serfs (us) continue to get squeezed because the price of goods and services will continue to go up due to the insane policy (theory) of expanding the money/credit supply.

We simply can't keep up.

Our monetary system is a giant Ponzi scheme, ran for the benefit of the Plutocrats, by the Plutocrats.

In general, the art of government consists of taking as much money as possible from one class of citizens to give to anther - Voltaire

The comfort of the rich depends upon an abundant supply of the poor - VoltaireYep, and their doing a swimmingly good job of it as well.

tl:dr

FUBAR

Friday, September 4, 2015

Thursday, September 3, 2015

Wednesday, August 26, 2015

Tuesday, August 25, 2015

Monday, August 24, 2015

Sunday, August 23, 2015

Thursday, August 13, 2015

Subscribe to:

Posts (Atom)