Friday, August 7, 2009

Employment situation - 8:32AM

Full report here

THE EMPLOYMENT SITUATION -- JULY 2009

Nonfarm payroll employment continued to decline in July (-247,000),

and the unemployment rate was little changed at 9.4 percent, the U.S.

Bureau of Labor Statistics reported today. The average monthly job

loss for May through July (-331,000) was about half the average

decline for November through April (-645,000). In July, job losses

continued in many of the major industry sectors.

Household Survey Data

In July, the number of unemployed persons was 14.5 million. The

unemployment rate was 9.4 percent, little changed for the second

consecutive month. (See table A-1.)

Among the major worker groups, unemployment rates for adult men (9.8

percent), adult women (7.5 percent), teenagers (23.8 percent), whites

(8.6 percent), blacks (14.5 percent), and Hispanics (12.3 percent)

were little changed in July. The unemployment rate for Asians was 8.3

percent, not seasonally adjusted. (See tables A-1, A-2, and A-3.)

The number of long-term unemployed (those jobless for 27 weeks or more)

rose by 584,000 over the month to 5.0 million. In July, 1 in 3 unemploy-

ed persons were jobless for 27 weeks or more. (See table A-9.)

The civilian labor force participation rate declined by 0.2 percentage

point in July to 65.5 percent. The employment-population ratio, at 59.4

percent, was little changed over the month but has declined by 3.3 per-

centage points since the recession began in December 2007. (See

table A-1.)

The number of persons working part time for economic reasons (sometimes

referred to as involuntary part-time workers) was little changed in July

at 8.8 million. The number of such workers rose sharply in the fall and

winter but has been little changed for 4 consecutive months.

(See table A-5.)

About 2.3 million persons were marginally attached to the labor force

in July, 709,000 more than a year earlier. (The data are not seasonally

adjusted.) These individuals, who were not in the labor force, wanted

and were available for work and had looked for a job sometime in the

prior 12 months. They were not counted as unemployed because they had

not searched for work in the 4 weeks preceding the survey. (See

table A-13.)

Among the marginally attached, there were 796,000 discouraged workers

in July, up by 335,000 over the past 12 months. (The data are not

seasonally adjusted.) Discouraged workers are persons not currently

looking for work because they believe no jobs are available for them.

The other 1.5 million persons marginally attached to the labor force

in July had not searched for work in the 4 weeks preceding the survey

for reasons such as school attendance or family responsibilities.

Establishment Survey Data

Total nonfarm payroll employment declined by 247,000 in July. From May

to July, job losses averaged 331,000 per month, compared with losses

averaging 645,000 per month from November to April. Since December

2007, payroll employment has fallen by 6.7 million. (See table B-1.)

Employment in construction declined by 76,000 in July, about in line

with the average for the past 3 months (-73,000). Employment had de-

creased by 117,000 a month on average from November to April.

Manufacturing employment fell by 52,000 in July and has declined by

2.0 million since the recession began. In motor vehicles and parts,

fewer workers than usual were laid off in July for seasonal retool-

ing. As a result, the estimate of employment for the industry rose

by 28,000 after seasonal adjustment. In large part, July's seasonally-

adjusted increase reflects the fact that previous job cuts had been

so extensive that there were fewer workers to lay off during the sea-

sonal shutdown. Elsewhere in manufacturing, several industries con-

tinued to lose jobs in July, including machinery (-15,000) and fabri-

cated metal products (-14,000).

In July, retail trade employment declined by 44,000. Job losses in the

industry had averaged 27,000 per month over the prior 3 months. Em-

ployment in wholesale trade fell by 19,000 in July, with the majority

of the decline occurring among durable goods wholesalers.

Employment in professional and business services continued to trend

down in July (-38,000); the industry has shed 1.5 million jobs since

the start of the recession. Within professional and business services,

employment in the temporary help industry edged down in July. While

temporary help has lost 844,000 jobs since the recession began, the

declines have lessened substantially over the past 3 months.

Transportation and warehousing lost 22,000 jobs in July. Since May,

the average monthly job loss was half the average monthly decline for

November through April (-17,000 versus -34,000).

Financial activities employment continued to trend down in July

(-13,000). The average monthly decline for this industry was 23,000

over the past 3 months compared with 46,000 per month from November

through April. Since the start of the recession, the financial acti-

vities industry has lost 501,000 jobs. Employment in information de-

clined by 16,000 in July, including losses in publishing and telecom-

munications.

Health care employment increased by 20,000 in July, about in line

with the average monthly gain for the first half of this year but

down from an average monthly increase of 30,000 during 2008. Employ-

ment in lei-sure and hospitality has been little changed over the

past 3 months.

In July, the average workweek of production and nonsupervisory work-

ers on private nonfarm payrolls edged up by 0.1 hour to 33.1 hours.

The manufacturing workweek increased by 0.3 hour to 39.8 hours. Fac-

tory overtime was unchanged at 2.9 hours. (See table B-2.)

In July, average hourly earnings of production and nonsupervisory

workers on private nonfarm payrolls rose by 3 cents, or 0.2 percent,

to $18.56. Over the past 12 months, average hourly earnings have

increased by 2.5 percent, while average weekly earnings have risen

by only 1.0 percent due to declines in the average workweek. (See

table B-3.)

The change in total nonfarm payroll employment for May was revised

from -322,000 to -303,000, and the change for June was revised from -

467,000 to -443,000.

_____________

The Employment Situation for August is scheduled to be released on Friday,

September 4, 2009, at 8:30 a.m. (EDT).

More at link

Labels:

Employment situation,

July

Pre-market - August 7th

Futures down slightly before the jobs numbers:

DJIA INDEX 9,200.00 -29.00

S&P 500 991.90 -3.00

NASDAQ 100 1,598.75 -2.50

Today's economic calendar:

Employment Situation 8:30 AM ET

Consumer Credit 3:00 PM ET

Almost 100 earnings reports today.

It's all about the job numbers today. It's really that simple.

Market wrap for Thursday - a day late - opps - 7:55AM

The market was tepid today, probably waiting on the job report due out at 8:30 on Friday:

Dow 9,256.26 -24.71 (-0.27%)

S&P 500 997.08 -5.64 (-0.56%)

Nasdaq 1,973.16 -19.89 (-1.00%)

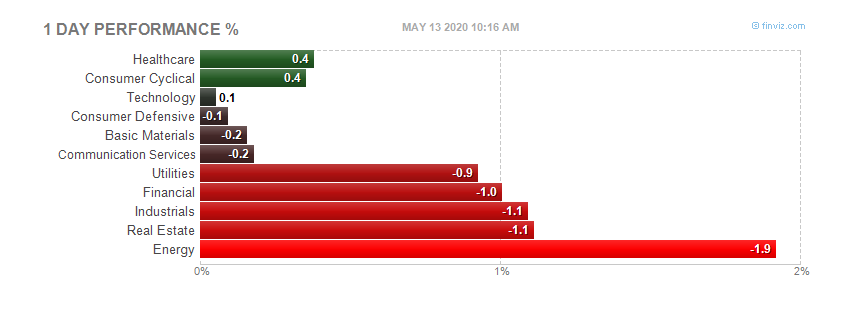

Today by sector:

Today's heatmap:

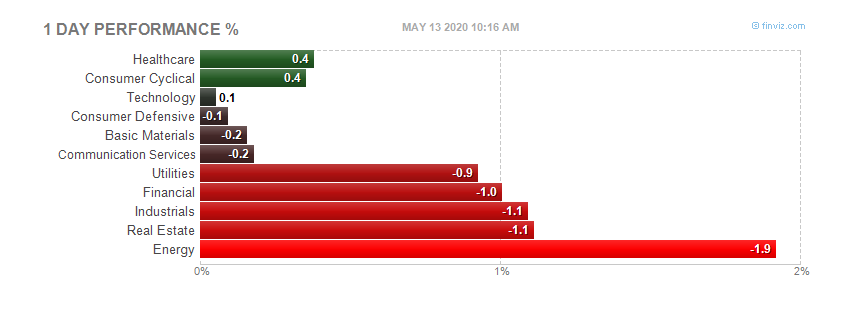

Today's heatmap:

Today's heatmap:

Today's heatmap:

Thursday, August 6, 2009

Jobless claims - 8:40AM

Full report here

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

SEASONALLY ADJUSTED DATA

In the week ending Aug. 1, the advance figure for seasonally adjusted initial claims was 550,000, a decrease of 38,000 from the previous week's revised figure of 588,000. The 4-week moving average was 555,250, a decrease of 4,750 from the previous week's revised average of 560,000.

The advance seasonally adjusted insured unemployment rate was 4.7 percent for the week ending July 25, unchanged from the prior week's unrevised rate of 4.7 percent.

The advance number for seasonally adjusted insured unemployment during the week ending July 25 was 6,310,000, an increase of 69,000 from the preceding week's revised level of 6,241,000. The 4-week moving average was 6,278,750, a decrease of 148,500 from the preceding week's revised average of 6,427,250.

The fiscal year-to-date average for seasonally adjusted insured unemployment for all programs is 5.522 million.

UNADJUSTED DATA

The advance number of actual initial claims under state programs, unadjusted, totaled 463,062 in the week ending Aug. 1, a decrease of 48,296 from the previous week. There were 382,792 initial claims in the comparable week in 2008.

The advance unadjusted insured unemployment rate was 4.5 percent during the week ending July 25, a decrease of 0.1 percentage point from the prior week. The advance unadjusted number for persons claiming UI benefits in state programs totaled 5,987,728, a decrease of 116,319 from the preceding week. A year earlier, the rate was 2.4 percent and the volume was 3,166,763.

Extended benefits were available in Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, the District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nevada, New Jersey, New York, North Carolina, Ohio, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, Washington, and Wisconsin during the week ending July 18.

Initial claims for UI benefits by former Federal civilian employees totaled 1,661 in the week ending July 25, a decrease of 30 from the prior week. There were 1,981 initial claims by newly discharged veterans, a decrease of 80 from the preceding week.

There were 19,783 former Federal civilian employees claiming UI benefits for the week ending July 18, an increase of 1,066 from the previous week. Newly discharged veterans claiming benefits totaled 30,107, an increase of 175 from the prior week.

States reported 2,754,391 persons claiming EUC (Emergency Unemployment Compensation) benefits for the week ending July 18, an increase of 97,512 from the prior week. There were 607,368 claimants in the comparable week in 2008. EUC weekly claims include both first and second tier activity.

The highest insured unemployment rates in the week ending July 18 were in Puerto Rico (8.0 percent), Michigan (6.7), Oregon (6.5), Pennsylvania (6.5), Nevada (6.1), Wisconsin (5.7), Connecticut (5.5), New Jersey (5.5), California (5.4), Rhode Island (5.3), and South Carolina (5.3).

The largest increases in initial claims for the week ending July 25 were in Ohio (+891), Oklahoma (+644), Mississippi (+222), Louisiana (+154), and Alaska (+129), while the largest decreases were in North Carolina (-9,809), Michigan (-9,085), Florida (-8,714), Georgia (-6,948), and Alabama (-3,822).

More at link - also tables I can't format

Labels:

Jobless claims,

July

Pre-market - August 6, 2009 - 7:50AM

Futures mixed waiting on the jobs report:

DJIA INDEX 9,265.00 20.00

S&P 500 1,002.60 1.80

NASDAQ 100 1,612.00 -2.50

Gold 966 -3 -0.35%

Oil 71.59 -0.38 -0.53%

Today's economic calendar:

Chain Store Sales

Monster Employment Index

BOE Announcement 7:00 AM ET - interest rate goes unchanged

ECB Announcement 7:45 AM ET

Jobless Claims 8:30 AM ET

EIA Natural Gas Report 10:30 AM ET

3-Month Bill Announcement 11:00 AM ET

6-Month Bill Announcement 11:00 AM ET

Treasury STRIPS 3:00 PM ET

Money Supply 4:30 PM ET

Over 400 earnings reports today

Market wrap - a day late - but better than never - 7:45AM Thursday

The markets dropped a little today after being down over 100 on the DOW at one point early in the day.

Dow 9,280.97 -39.22 (-0.42%)

S&P 500 1,002.72 -2.93 (-0.29%)

Nasdaq 1,993.05 -18.26 (-0.91%)

Today by sector:

The banks win again. Shocked I tell ya! And the REITs. Who's buying that crap?

Today's heatmap:

The banks win again. Shocked I tell ya! And the REITs. Who's buying that crap?

Today's heatmap:

The banks win again. Shocked I tell ya! And the REITs. Who's buying that crap?

Today's heatmap:

The banks win again. Shocked I tell ya! And the REITs. Who's buying that crap?

Today's heatmap:

Wednesday, August 5, 2009

Crude oil and distillates report - 10:45AM

Full report here

Summary of Weekly Petroleum Data for the Week Ending July 31, 2009

U.S. crude oil refinery inputs averaged 14.4 million barrels per day during the

week ending July 31, 174 thousand barrels per day below the previous week's

average. Refineries operated at 84.5 percent of their operable capacity last

week. Gasoline production increased last week, averaging 9.1 million barrels

per day. Distillate fuel production decreased last week, averaging about 3.8

million barrels per day.

U.S. crude oil imports averaged 9.3 million barrels per day last week, down 737

thousand barrels per day from the previous week. Over the last four weeks,

crude oil imports have averaged 9.5 million barrels per day, 590 thousand

barrels per day below the same four-week period last year. Total motor gasoline

imports (including both finished gasoline and gasoline blending components)

last week averaged 1.0 million barrels per day. Distillate fuel imports

averaged 141 thousand barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) increased by 1.7 million barrels from the previous week. At

349.5 million barrels, U.S. crude oil inventories are above the upper boundary

of the average range for this time of year. Total motor gasoline inventories

decreased by 0.2 million barrels last week, and are in the upper half of the

average range. Both finished gasoline inventories and gasoline blending

components decreased last week. Distillate fuel inventories decreased by 1.1

million barrels, and are above the upper boundary of the average range for

this time of year. Propane/propylene inventories increased by 0.6 million

barrels last week and are above the upper limit of the average range. Total

commercial petroleum inventories decreased by 2.7 million barrels last week,

and are above the upper limit of the average range for this time of year.

Total products supplied over the last four-week period has averaged 18.9

million barrels per day, down by 3.1 percent compared to the similar period

last year. Over the last four weeks, motor gasoline demand has averaged about

9.2 million barrels per day, up by 0.5 percent from the same period last year.

Distillate fuel demand has averaged about 3.4 million barrels per day over the

last four weeks, down by 7.9 percent from the same period last year. Jet fuel

demand is 11.9 percent lower over the last four weeks compared to the same

four-week period last year.

More at link - more data I cannot format. There will be a much better formatted report out around 1:00 this afternoon. Go to link to see full report as formatted by the EIA.

ISM manufacturing report - 10:10AM

Full report here

July 2009 Non-Manufacturing ISM Report On Business®

NMI (Non-Manufacturing Index) at 46.4%

DO NOT CONFUSE THIS NATIONAL REPORT with the various regional purchasing reports released across the country. The national report's information reflects the entire United States, while the regional reports contain primarily regional data from their local vicinities. Also, the information in the regional reports is not used in calculating the results of the national report. The information compiled in this report is for the month of July 2009.

Business Activity Index at 46.1%

New Orders Index at 48.1%

Employment Index at 41.5%

(Tempe, Arizona) — Economic activity in the non-manufacturing sector contracted in July, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Hotels Corporation. "The NMI (Non-Manufacturing Index) registered 46.4 percent in July, 0.6 percentage point lower than the 47 percent registered in June, indicating contraction in the non-manufacturing sector for the 10th consecutive month, at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 3.7 percentage points to 46.1 percent. The New Orders Index decreased 0.5 percentage point to 48.1 percent, and the Employment Index decreased 1.9 percentage points to 41.5 percent. The Prices Index decreased 12.4 percentage points to 41.3 percent in July, indicating a significant decrease in prices paid from June. According to the NMI, seven non-manufacturing industries reported growth in July. The majority of respondents' comments reflect a sense of uncertainty and cautiousness about business conditions."

INDUSTRY PERFORMANCE (Based on the NMI)

The seven industries reporting growth in July based on the NMI composite index — listed in order — are: Real Estate, Rental & Leasing; Arts, Entertainment & Recreation; Agriculture, Forestry, Fishing & Hunting; Mining; Information; Health Care & Social Assistance; and Retail Trade. The 10 industries reporting contraction in July — listed in order — are: Other Services; Management of Companies & Support Services; Public Administration; Finance & Insurance; Wholesale Trade; Professional, Scientific & Technical Services; Transportation & Warehousing; Construction; Educational Services; and Accommodation & Food Services.

WHAT RESPONDENTS ARE SAYING ...

* "Economic activity continues to decline." (Transportation & Warehousing)

* "Continued soft sales, offset by improving profit margins." (Accommodation & Food Services)

* "Stimulus funds have increased business activity." (Public Administration)

* "Business downturn seems to be stabilizing somewhat." (Information)

* "There is still downward pressure on our products; however, our sales volume is stabilizing." (Mining)

* "The past month's volume target and operating volumes were met. Rising concerns over the future form of healthcare reform and impact on provider organizations." (Health Care & Social Assistance)

* "Although attendance is up, business levels remain steady. More people, fewer dollars spent — an indication that discretionary spending is limited." (Arts, Entertainment & Recreation)

Much more at link - too many tables I cannot format

Much more at link - too many tables I cannot format

Much more at link - too many tables I cannot format

Much more at link - too many tables I cannot format

Factory Orders - 10:04AM

Full report here

HIGHLIGHTS FROM THE PRELIMINARY REPORT ON MANUFACTURERS' SHIPMENTS, INVENTORIES, AND ORDERS

June 2009 --------------- Released 10:00 A.M. EDT August 5, 2009

(M3-2(09)-06)

Note: All figures in text are in seasonally adjusted current dollars

For Data - (301) 763-4673

For Questions - Chris Savage or Jessica Young

(301) 763-4832

Summary

New orders for manufactured goods in June, up four of the last five months, increased $1.4 billion or 0.4 percent to $349.0 billion, the U.S. Census Bureau reported today. This followed a 1.1 percent May increase. Excluding transportation, new orders increased 2.3 percent. Shipments, up following ten consecutive monthly decreases, increased $4.9 billion or 1.4 percent to $358.3 billion. This followed a 0.8 percent May decrease. Unfilled orders, down nine consecutive months, decreased $6.5 billion or 0.9 percent to $740.2 billion. This was the longest streak of consecutive monthly decreases since November 2001-July 2002. This followed a 0.3 percent May decrease. The unfilled orders-to-shipments ratio was 6.04, down from 6.15 in May. Inventories, down ten consecutive months, decreased $4.2 billion or 0.8 percent to $508.3 billion. This was the longest streak of consecutive monthly decreases since March 2003-January 2004 and followed a 0.8 percent May decrease. The inventories-to-shipments ratio was 1.42, down from 1.45 in May.

New Orders

New orders for manufactured durable goods in June, down following two consecutive monthly increases, decreased $3.6 billion or 2.2 percent to $159.1 billion, revised from the previously published 2.5 percent decrease. This followed a 1.3 percent May increase.

New orders for manufactured nondurable goods increased $5.0 billion or 2.7 percent to $190.0 billion.

Shipments

Shipments of manufactured durable goods in June, down eleven consecutive months, decreased $0.1 billion or 0.1 percent to $168.3 billion, revised from the previously published 0.2 percent decrease. This also was the longest streak of consecutive monthly decreases since the series was first published on a NAICS basis in 1992 and followed a 2.7 percent May decrease.

Shipments of manufactured nondurable goods, up two consecutive months, increased $5.0 billion or 2.7 percent to $190.0 billion. This followed a 0.9 percent May increase. This increase was led by petroleum and coal products, which increased $4.3 billion or 13.2 percent to $37.1 billion. This was the largest increase in petroleum and coal products since November 2007.

Unfilled Orders

Unfilled orders for manufactured durable goods in June, down nine consecutive months, decreased $6.5 billion or 0.9 percent to $740.2 billion, unchanged from the previously published decrease. This followed a 0.3 percent May decrease.

Inventories

Inventories of manufactured durable goods in June, down six consecutive months, decreased $3.8 billion or 1.2 percent to $317.8 billion, revised from the previously published 0.9 percent decrease. This followed a 1.2 percent May decrease.

Inventories of manufactured nondurable goods, down ten consecutive months, decreased $0.4 billion or 0.2 percent to $190.6 billion. This followed a 0.1 percent May decrease. Chemical products drove the decrease, down $0.7 billion or 1.2 percent to $63.1 billion.

By stage of fabrication, June materials and supplies decreased 1.3 percent in durable goods and increased 0.4 percent in nondurable goods. Work in process decreased 0.6 percent in durable goods and 0.8 percent in nondurable goods. Finished goods decreased 1.9 percent in durable goods and 0.4 percent in nondurable goods.

Labels:

Factory orders

Treasury refunding report - 9:10AM

Full report here

August 2009 Quarterly Refunding Statement

Washington, DC – We are offering $75.0 billion of Treasury securities to refund approximately $60.9 billion of privately held securities maturing on August 15, 2009 and to raise approximately $14.1 billion. The securities are:

* A 3-year note in the amount of $37.0 billion, maturing August 15, 2012;

* A 10-year note in the amount of $23.0 billion, maturing August 15, 2019; and

* A 30-year bond in the amount of $15.0 billion, maturing August 15, 2039.

The 3-year note will be auctioned on a yield basis at 1:00 p.m. EDT on Tuesday, August 11, 2009. The 10-year note will be auctioned on a yield basis at 1:00 p.m. EDT on Wednesday, August 12, 2009, and the 30-year bond will be auctioned on a yield basis at 1:00 p.m. EDT on Thursday, August 13, 2009. All of these auctions will settle on Monday, August 17, 2009.

The balance of our financing requirements will be met with weekly bills; monthly 52-week bills; monthly 2-year, 3-year, 5-year, and 7-year notes; the September and October 10-year note and 30-year bond reopenings; and the October 5-year and 10-year TIPS reopenings.

Treasury will also issue cash management bills, some longer dated, during the quarter.

Financing Needs and Portfolio Considerations

During the last eighteen months, Treasury has responded to increasing marketable borrowing requirements in a deliberate manner, consistent with our operating framework of being regular and predictable. At the same time, our strategy continues to ensure maximum flexibility for debt managers.

Currently we believe our existing suite of nominal securities is sufficient to address our borrowing needs; however, market participants should expect auction sizes to continue to rise in a gradual manner over the medium term. In addition, to increase our flexibility, issuance of Treasury inflation-indexed securities will also increase gradually.

Nevertheless, Treasury will continue to monitor projected financing needs and make adjustments to the auction calendar, if necessary. These include, but are not limited to, the reintroduction or establishment of other benchmark securities or other changes to the auction calendar for existing nominal and inflation-indexed securities.

Treasury Inflation-Indexed Securities (TIPS)

Treasury is committed to issuing TIPS in a regular and predictable manner across the yield curve. These securities are an important part of our overall debt management strategy, and market participants can expect issuance to gradually increase in FY 2010.

Additionally, to potentially improve liquidity in the TIPS program and better capture the premium associated with inflation protection, Treasury will consider replacing 20-year TIPS with 30-year TIPS.

Any potential changes to the TIPS program will be announced at the November 2009 refunding.

Private Sector Initiatives to Improve the Functioning of Treasury Repurchase Markets

Chronic settlement fails in the Treasury repurchase market in 2008 led the Treasury Market Practices Group (TMPG), working alongside members of the Securities Industry and Financial Markets Association (SIFMA) and the Depository Trust and Clearing Corporation (DTCC) to issue guidelines aimed at minimizing episodes of chronic fails.

On May 1, 2009 market participants adopted and implemented the TMPG's Fails Charge recommendations. In response to these measures, settlement fails in the Treasury market have declined significantly. Treasury commends the efforts by the TMPG and other private sector groups to craft these changes as they have served to enhance the liquidity of the Treasury market.

In addition, to ensure the orderly implementation of the Fails Charge, the IRS announced on July 28, 2009 that it will not challenge a position taken by a taxpayer or a withholding agent that a Fails Charge paid on or before December 31, 2010 is not subject to U.S. gross-basis taxation unless contrary guidance has been issued effective before that date.

Debt Subject to the Limit

Based on current projections, Treasury expects to reach the debt ceiling in the last quarter of calendar year 2009. Given the uncertainty surrounding potential borrowing needs, Treasury will continue to keep Congress and financial market participants apprised of developments as the debt outstanding approaches the statutory limit.

Please send comments and suggestions on these subjects or others related to Treasury debt management to debt.management@do.treas.gov.

The next quarterly refunding announcement will take place on Wednesday, November 4, 2009.

Labels:

August 5,

Treasury refunding report

ADP Report for July - 9:03AM

Full report here

ADP NATIONAL EMPLOYMENT REPORT SHOWS U.S.

EMPLOYMENT DECREASED BY 371,000 PRIVATE SECTOR JOBS IN JULY

ROSELAND, N.J. – August 5, 2009 – According to today’s ADP National Employment

Report®, private sector employment decreased by 371,000 in July. The ADP National

Employment Report, created by ADP® Employer Services, a division of Automatic Data

Processing, Inc. (ADP), in partnership with Macroeconomic Advisers, LLC, is derived

from actual payroll data and measures the change in total nonfarm private employment

each month.

Nonfarm Private Employment Highlights – July Report:

• Total employment: -371,000

• Small businesses* -138,000

• Medium businesses** -159,000

• Large businesses*** -74,000

• Goods-producing sector: -169,000

• Service-providing sector: -202,000

Addendum:

• Manufacturing industry: -99,000

* Small businesses represent payrolls with 1-49 employees

** Medium businesses represent payrolls with 50-499 employees

*** Large businesses represent payrolls with more than 499 employees

According to Joel Prakken, Chairman of Macroeconomic Advisers, LLC, “Nonfarm private employment decreased 371,000 from June to July 2009 on a seasonally adjusted basis, according to the ADP National Employment Report. July’s employment decline was the smallest since October of 2008 and continues the notable improvement between the first and second quarters of 2009. Nevertheless, despite recent indications that overall economic activity is stabilizing, employment, which usually trails overall economic activity, is likely to decline for at least several more months, albeit at a diminishing rate.”

Prakken added, “July’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 202,000. Employment in the goods-producing sector

declined 169,000, with employment in the manufacturing sector dropping 99,000, its

smallest monthly decline since September of 2008.”

“Large businesses, defined as those with 500 or more workers, saw employment decline

by 74,000, while medium-size businesses with between 50 and 499 workers declined

159,000. Employment among small-size businesses, defined as those with fewer than 50

workers, declined 138,000,” said Prakken.

Prakken went on to say, “In July, construction employment dropped 64,000. This was its thirtieth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,483,000. Employment in the financial services sector dropped 26,000, the twentieth consecutive monthly decline.”

More info in report - tables that I cannot format here

Interesting article on the Oracle of Omaha - while we wait for the economic numbers - 8:50AM

This was spotted on another blog, but I would like to have a link, so I will share with everyone. Pretty interesting to say the least:

Full article with links here - From Reuters blog

Buffett’s Betrayal

Posted by: Rolfe Winkler

When I was 14, Warren Buffett wrote me a letter.

It was a response to one I’d sent him, pitching an investment idea. For a kid interested in learning stocks, Buffett was a great role model. His investing style — diligent security analysis, finding competent management, patience — was immediately appealing.

Buffett was kind enough to respond to my letter, thanking me for it and inviting me to his company’s annual meeting. I was hooked. Today, Buffett remains famous for investing The Right Way. He even has a television cartoon in the works, which will groom the next generation of acolytes.

But it turns out much of the story is fiction. A good chunk of his fortune is dependent on taxpayer largess. Were it not for government bailouts, for which Buffett lobbied hard, many of his company’s stock holdings would have been wiped out.

Berkshire Hathaway, in which Buffett owns 27 percent, according to a recent proxy filing, has more than $26 billion invested in eight financial companies that have received bailout money. The TARP at one point had nearly $100 billion invested in these companies and, according to new data released by Thomson Reuters, FDIC backs more than $130 billion of their debt.

To put that in perspective, 75 percent of the debt these companies have issued since late November has come with a federal guarantee. (Click chart to enlarge in new window)

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

He even traded the bailout, seeking morally hazardous profits in preferred stock and warrants of Goldman and GE because he had “confidence in Congress to do the right thing” — to rescue shareholders in too-big-to-fail financials from the losses that were rightfully theirs to absorb.

Keeping this in mind, I was struck by Buffett’s letter to Berkshire shareholders this year:

“Funders that have access to any sort of government guarantee — banks with FDIC-insured deposits, large entities with commercial paper now backed by the Federal Reserve, and others who are using imaginative methods (or lobbying skills) to come under the government’s umbrella — have money costs that are minimal,” he wrote.

“Conversely, highly-rated companies, such as Berkshire, are experiencing borrowing costs that … are at record levels. Moreover, funds are abundant for the government-guaranteed borrower but often scarce for others, no matter how creditworthy they may be.”

It takes remarkable chutzpah to lobby for bailouts, make trades seeking to profit from them, and then complain that those doing so put you at a disadvantage.

Elsewhere in his letter he laments “atrocious sales practices” in the financial industry, holding up Berkshire subsidiary Clayton Homes as a model of lending rectitude.

Conveniently, he neglects to mention Wells Fargo’s toxic book of home equity loans, American Express’ exploding charge-offs, GE Capital’s awful balance sheet, Bank of America’s disastrous acquisitions of Countrywide and Merrill Lynch, and Goldman Sachs’ reckless trading practices.

And what of Moody’s, the credit-rating agency that enabled lending excesses Buffett criticizes, and in which he’s held a major stake for years? Recently Berkshire cut its stake to 16 percent from 20 percent. Publicly, however, the Oracle of Omaha has been silent.

This is remarkably incongruous for the world’s most famous financial straight-shooter. Few have called him on it, though one notable exception was a good article by Charles Piller in the Sacramento Bee earlier this year.

Buffett didn’t respond to my email seeking a comment.

What saddens me is that Buffett is uniquely positioned to lobby for better public policy, but he’s chosen to spend his considerable political capital protecting his own holdings.

If we learn one lesson from this episode, it’s that banks should carry substantially more capital than may be necessary. You would think Buffett would agree. He has always emphasized investing with a “margin of safety” — so why shouldn’t banks lend with one?

Yet he mocked Tim Geithner’s stress tests, which forced banks to replenish their capital. Why? Is it because his banks are drastically undercapitalized? The more capital they’re forced to raise, the more his stake is diluted.

He points to Wells Fargo’s deposit funding model being more robust than investment banks’, but that’s no excuse for letting tangible equity dwindle to three percent of assets. At that low level, the capital structure would have collapsed were it not for bailouts.

And by the way, the strength of Wells’ funding model is a result of FDIC insurance, among the government subsidies Buffett complains about in this year’s letter.

To me this feels like a betrayal. There’s a reason he’s Warren Buffett and not, say, Carl Icahn.

As Roger Lowenstein wrote in his 1995 biography of Buffett, “Wall Street’s modern financiers got rich by exploiting their control of the public’s money … Buffett shunned this game … In effect, he rediscovered the art of pure capitalism — a cold-blooded sport, but a fair one.”

But there’s nothing fair about Buffett getting a bailout, about exploiting the taxpaying public for his own gain. The naïve 14-year-olds among us thought he was better than this.

What would Ben Graham say?

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

He even traded the bailout, seeking morally hazardous profits in preferred stock and warrants of Goldman and GE because he had “confidence in Congress to do the right thing” — to rescue shareholders in too-big-to-fail financials from the losses that were rightfully theirs to absorb.

Keeping this in mind, I was struck by Buffett’s letter to Berkshire shareholders this year:

“Funders that have access to any sort of government guarantee — banks with FDIC-insured deposits, large entities with commercial paper now backed by the Federal Reserve, and others who are using imaginative methods (or lobbying skills) to come under the government’s umbrella — have money costs that are minimal,” he wrote.

“Conversely, highly-rated companies, such as Berkshire, are experiencing borrowing costs that … are at record levels. Moreover, funds are abundant for the government-guaranteed borrower but often scarce for others, no matter how creditworthy they may be.”

It takes remarkable chutzpah to lobby for bailouts, make trades seeking to profit from them, and then complain that those doing so put you at a disadvantage.

Elsewhere in his letter he laments “atrocious sales practices” in the financial industry, holding up Berkshire subsidiary Clayton Homes as a model of lending rectitude.

Conveniently, he neglects to mention Wells Fargo’s toxic book of home equity loans, American Express’ exploding charge-offs, GE Capital’s awful balance sheet, Bank of America’s disastrous acquisitions of Countrywide and Merrill Lynch, and Goldman Sachs’ reckless trading practices.

And what of Moody’s, the credit-rating agency that enabled lending excesses Buffett criticizes, and in which he’s held a major stake for years? Recently Berkshire cut its stake to 16 percent from 20 percent. Publicly, however, the Oracle of Omaha has been silent.

This is remarkably incongruous for the world’s most famous financial straight-shooter. Few have called him on it, though one notable exception was a good article by Charles Piller in the Sacramento Bee earlier this year.

Buffett didn’t respond to my email seeking a comment.

What saddens me is that Buffett is uniquely positioned to lobby for better public policy, but he’s chosen to spend his considerable political capital protecting his own holdings.

If we learn one lesson from this episode, it’s that banks should carry substantially more capital than may be necessary. You would think Buffett would agree. He has always emphasized investing with a “margin of safety” — so why shouldn’t banks lend with one?

Yet he mocked Tim Geithner’s stress tests, which forced banks to replenish their capital. Why? Is it because his banks are drastically undercapitalized? The more capital they’re forced to raise, the more his stake is diluted.

He points to Wells Fargo’s deposit funding model being more robust than investment banks’, but that’s no excuse for letting tangible equity dwindle to three percent of assets. At that low level, the capital structure would have collapsed were it not for bailouts.

And by the way, the strength of Wells’ funding model is a result of FDIC insurance, among the government subsidies Buffett complains about in this year’s letter.

To me this feels like a betrayal. There’s a reason he’s Warren Buffett and not, say, Carl Icahn.

As Roger Lowenstein wrote in his 1995 biography of Buffett, “Wall Street’s modern financiers got rich by exploiting their control of the public’s money … Buffett shunned this game … In effect, he rediscovered the art of pure capitalism — a cold-blooded sport, but a fair one.”

But there’s nothing fair about Buffett getting a bailout, about exploiting the taxpaying public for his own gain. The naïve 14-year-olds among us thought he was better than this.

What would Ben Graham say?

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

He even traded the bailout, seeking morally hazardous profits in preferred stock and warrants of Goldman and GE because he had “confidence in Congress to do the right thing” — to rescue shareholders in too-big-to-fail financials from the losses that were rightfully theirs to absorb.

Keeping this in mind, I was struck by Buffett’s letter to Berkshire shareholders this year:

“Funders that have access to any sort of government guarantee — banks with FDIC-insured deposits, large entities with commercial paper now backed by the Federal Reserve, and others who are using imaginative methods (or lobbying skills) to come under the government’s umbrella — have money costs that are minimal,” he wrote.

“Conversely, highly-rated companies, such as Berkshire, are experiencing borrowing costs that … are at record levels. Moreover, funds are abundant for the government-guaranteed borrower but often scarce for others, no matter how creditworthy they may be.”

It takes remarkable chutzpah to lobby for bailouts, make trades seeking to profit from them, and then complain that those doing so put you at a disadvantage.

Elsewhere in his letter he laments “atrocious sales practices” in the financial industry, holding up Berkshire subsidiary Clayton Homes as a model of lending rectitude.

Conveniently, he neglects to mention Wells Fargo’s toxic book of home equity loans, American Express’ exploding charge-offs, GE Capital’s awful balance sheet, Bank of America’s disastrous acquisitions of Countrywide and Merrill Lynch, and Goldman Sachs’ reckless trading practices.

And what of Moody’s, the credit-rating agency that enabled lending excesses Buffett criticizes, and in which he’s held a major stake for years? Recently Berkshire cut its stake to 16 percent from 20 percent. Publicly, however, the Oracle of Omaha has been silent.

This is remarkably incongruous for the world’s most famous financial straight-shooter. Few have called him on it, though one notable exception was a good article by Charles Piller in the Sacramento Bee earlier this year.

Buffett didn’t respond to my email seeking a comment.

What saddens me is that Buffett is uniquely positioned to lobby for better public policy, but he’s chosen to spend his considerable political capital protecting his own holdings.

If we learn one lesson from this episode, it’s that banks should carry substantially more capital than may be necessary. You would think Buffett would agree. He has always emphasized investing with a “margin of safety” — so why shouldn’t banks lend with one?

Yet he mocked Tim Geithner’s stress tests, which forced banks to replenish their capital. Why? Is it because his banks are drastically undercapitalized? The more capital they’re forced to raise, the more his stake is diluted.

He points to Wells Fargo’s deposit funding model being more robust than investment banks’, but that’s no excuse for letting tangible equity dwindle to three percent of assets. At that low level, the capital structure would have collapsed were it not for bailouts.

And by the way, the strength of Wells’ funding model is a result of FDIC insurance, among the government subsidies Buffett complains about in this year’s letter.

To me this feels like a betrayal. There’s a reason he’s Warren Buffett and not, say, Carl Icahn.

As Roger Lowenstein wrote in his 1995 biography of Buffett, “Wall Street’s modern financiers got rich by exploiting their control of the public’s money … Buffett shunned this game … In effect, he rediscovered the art of pure capitalism — a cold-blooded sport, but a fair one.”

But there’s nothing fair about Buffett getting a bailout, about exploiting the taxpaying public for his own gain. The naïve 14-year-olds among us thought he was better than this.

What would Ben Graham say?

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

He even traded the bailout, seeking morally hazardous profits in preferred stock and warrants of Goldman and GE because he had “confidence in Congress to do the right thing” — to rescue shareholders in too-big-to-fail financials from the losses that were rightfully theirs to absorb.

Keeping this in mind, I was struck by Buffett’s letter to Berkshire shareholders this year:

“Funders that have access to any sort of government guarantee — banks with FDIC-insured deposits, large entities with commercial paper now backed by the Federal Reserve, and others who are using imaginative methods (or lobbying skills) to come under the government’s umbrella — have money costs that are minimal,” he wrote.

“Conversely, highly-rated companies, such as Berkshire, are experiencing borrowing costs that … are at record levels. Moreover, funds are abundant for the government-guaranteed borrower but often scarce for others, no matter how creditworthy they may be.”

It takes remarkable chutzpah to lobby for bailouts, make trades seeking to profit from them, and then complain that those doing so put you at a disadvantage.

Elsewhere in his letter he laments “atrocious sales practices” in the financial industry, holding up Berkshire subsidiary Clayton Homes as a model of lending rectitude.

Conveniently, he neglects to mention Wells Fargo’s toxic book of home equity loans, American Express’ exploding charge-offs, GE Capital’s awful balance sheet, Bank of America’s disastrous acquisitions of Countrywide and Merrill Lynch, and Goldman Sachs’ reckless trading practices.

And what of Moody’s, the credit-rating agency that enabled lending excesses Buffett criticizes, and in which he’s held a major stake for years? Recently Berkshire cut its stake to 16 percent from 20 percent. Publicly, however, the Oracle of Omaha has been silent.

This is remarkably incongruous for the world’s most famous financial straight-shooter. Few have called him on it, though one notable exception was a good article by Charles Piller in the Sacramento Bee earlier this year.

Buffett didn’t respond to my email seeking a comment.

What saddens me is that Buffett is uniquely positioned to lobby for better public policy, but he’s chosen to spend his considerable political capital protecting his own holdings.

If we learn one lesson from this episode, it’s that banks should carry substantially more capital than may be necessary. You would think Buffett would agree. He has always emphasized investing with a “margin of safety” — so why shouldn’t banks lend with one?

Yet he mocked Tim Geithner’s stress tests, which forced banks to replenish their capital. Why? Is it because his banks are drastically undercapitalized? The more capital they’re forced to raise, the more his stake is diluted.

He points to Wells Fargo’s deposit funding model being more robust than investment banks’, but that’s no excuse for letting tangible equity dwindle to three percent of assets. At that low level, the capital structure would have collapsed were it not for bailouts.

And by the way, the strength of Wells’ funding model is a result of FDIC insurance, among the government subsidies Buffett complains about in this year’s letter.

To me this feels like a betrayal. There’s a reason he’s Warren Buffett and not, say, Carl Icahn.

As Roger Lowenstein wrote in his 1995 biography of Buffett, “Wall Street’s modern financiers got rich by exploiting their control of the public’s money … Buffett shunned this game … In effect, he rediscovered the art of pure capitalism — a cold-blooded sport, but a fair one.”

But there’s nothing fair about Buffett getting a bailout, about exploiting the taxpaying public for his own gain. The naïve 14-year-olds among us thought he was better than this.

What would Ben Graham say?

Labels:

Warren Buffett

Pre-market - August 5 - 7:45AM

Futures pretty much flat today before some important economic numbers:

DJIA INDEX 9,277.00 -10.00

S&P 500 1,003.60 -1.10

NASDAQ 100 1,627.25 -3.00

Gold 970 11 1.14%

Oil 71.40 -0.02 -0.03%

Today's economic calendar:

Challenger Job-Cut Report 7:30 AM ET

ADP Employment Report 8:15 AM ET

Treasury Refunding Announcement 9:00 AM ET

10-Yr Note Announcement 9:00 AM ET

30-Yr Bond Announcement 9:00 AM ET

Factory Orders 10:00 AM ET

ISM Non-Mfg Index 10:00 AM ET

EIA Petroleum Status Report 10:30 AM ET

3-Yr Note Announcement 11:00 AM ET

Many earnings reports today

Tuesday, August 4, 2009

Market wrap - 4:45

Ho hum, another up day for the market.

Dow 9,320.19 +33.63 (0.36%)

S&P 500 1,005.65 +3.02 (0.30%)

Nasdaq 2,011.31 +2.70 (0.13%)

Gold 970 11 1.14%

Oil 71.85 -0.16 -0.22%

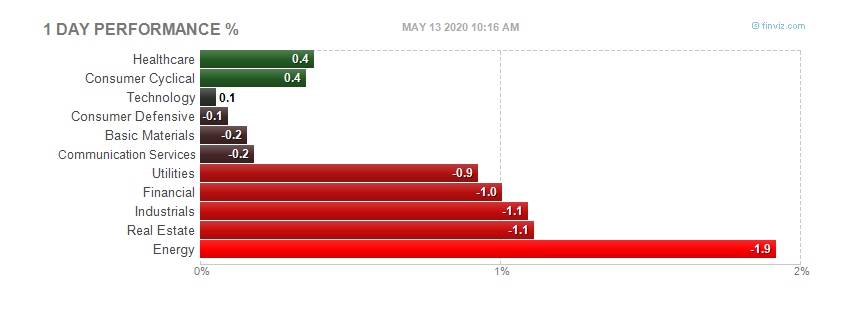

Today by sector:

Today's heatmap:

Today's heatmap:

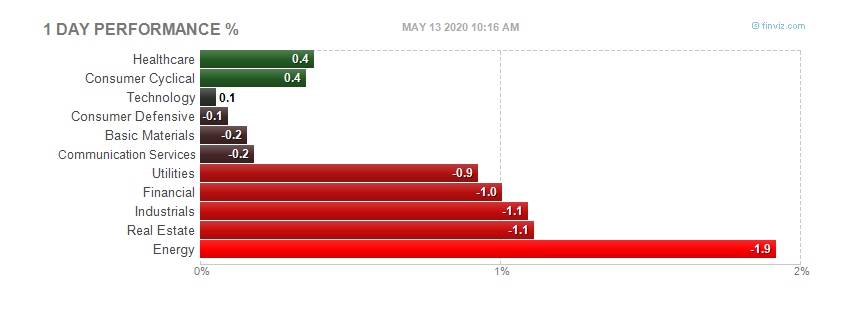

Today's heatmap:

Today's heatmap:

GE Pays $50 Million to End SEC Claims It Manipulated Earnings - 12:40AM

GE Pays $50 Million to End SEC Claims It Manipulated Earnings - Bloomberg

Aug. 4 (Bloomberg) -- General Electric Co., the world’s biggest maker of locomotives and medical imaging equipment, agreed to pay $50 million to settle U.S. regulatory claims it manipulated earnings to meet analysts’ estimates.

The company broke accounting rules four times in 2002 and 2003 to increase earnings or avoid reporting negative financial results, the Securities and Exchange Commission said in a lawsuit in federal court in Connecticut today.

“GE bent the accounting rules beyond the breaking point,” SEC Enforcement Director Robert Khuzami said in a statement. “Overly aggressive accounting can distort a company’s true financial condition and mislead investors.”

The company, based in Fairfield, Connecticut, settled without admitting or denying wrongdoing. The accord also bars GE from violating the antifraud, reporting, record-keeping and internal-controls laws, the SEC said.

The SEC’s investigation isn’t over, according to David Bergers, head of the agency’s Boston office.

“With respect to the company, the investigation is concluded,” he said in an interview today. “With respect to others the investigation is continuing.”

To contact the reporter on this story: David Scheer in New York at dscheer@bloomberg.net.

Last Updated: August 4, 2009 10:59 EDT

What else are they manipulating? Everything on CNBC is manipulated to sound good it seems. What a joke of a financial news network. Turn them off.

What else are they manipulating? Everything on CNBC is manipulated to sound good it seems. What a joke of a financial news network. Turn them off.

Pending home sales - June - 10:17AM

Full report here

Uptrend Continues in Pending Home Sales

Washington, August 04, 2009

Pending home sales are up for the fifth consecutive month, the first time in six years for such a streak, according to the National Association of Realtors®.

The Pending Home Sales Index,1 a forward-looking indicator based on contracts signed in June, rose 3.6 percent to 94.6 from an upwardly revised reading of 91.3 in May, and is 6.7 percent above June 2008 when it was 88.7. The last time there were five consecutive monthly gains was in July 2003.

Lawrence Yun, NAR chief economist, said a combination of positive market factors is fueling the gains. “Historically low mortgage interest rates, affordable home prices and large selection are encouraging buyers who’ve been on the sidelines. Activity has been consistently much stronger for lower priced homes,” he said. “Because it may take as long as two months to close on a home after signing a contract, first-time buyers must act fairly soon to take advantage of the $8,000 tax credit because they must close on the sale by November 30.

The Pending Home Sales Index in the Northeast rose 0.4 percent to 81.2 in June and is 5.8 percent above a year ago. In the Midwest the index increased 0.8 percent to 89.9 and is 11.6 percent above June 2008. The index in the South jumped 7.1 percent to 100.7 in June and is 8.9 percent higher than a year ago. In the West the index rose 2.9 percent to 100.4 but is 0.2 percent below June 2008.

NAR President Charles McMillan, a broker with Coldwell Banker Residential Brokerage in Dallas-Fort Worth, is hopeful that a recently elevated level of contract cancellations will ease. “Last month, Freddie Mac and Fannie Mae clarified that appraisals should be done by professionals with clear local expertise,” he said. “This should mitigate the situation of many valuations done by out-of-area appraisers coming in below the price negotiated between buyers and sellers. Hopefully, in the months ahead, we’ll see an even closer relationship between contract activity and closed transactions.”

McMillan said NAR is continuing to press the appraisal issue. “We have asked Congress and the Federal Housing Finance Agency to immediately implement an 18-month moratorium on the new appraisal rules to further address unintended consequences of the new guidelines,” he said.

NAR’s Housing Affordability Index2 remains very favorable. The affordability index stood at 159.2 in July, down from record peaks in recent months but it remains 36.6 percentage points above a year ago. Under these conditions the typical family would devote 15.7 percent of gross income to mortgage principal and interest, well below the standard allowance of 25 percent.

The HAI is a broad measure of housing affordability using consistent values and assumptions over time, which examines the relationship between home prices, mortgage interest rates and family income.

“A monthly rise in home prices and somewhat higher mortgage interest rates led to a modest decline in affordability in June, but it was still the sixth highest index on record dating back to 1970,” Yun said. “Because housing is so affordable in today’s market, job security and the first-time buyer tax credit are bigger factors in influencing home sales.”

A median-income family, earning $60,700, could afford a home costing $289,100 in June with a 20 percent downpayment, assuming 25 percent of gross income is devoted to mortgage principal and interest. Affordability conditions for first-time buyers with the same income and small downpayments are roughly 80 percent of what a median-income family can afford. The affordable price was much higher than the median existing single-family home price in June, which was $181,600.

Yun expects existing-home sales to gradually rise over the balance of the year, with conditions varying around the country. “It appears home sales are on a sounder footing and inventory is gradually being absorbed.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.2 million members involved in all aspects of the residential and commercial real estate industries.

Labels:

June,

Pending home sales

Personal income and outlays - 8:40AM

Full report here

PERSONAL INCOME AND OUTLAYS: JUNE 2009

REVISED ESTIMATES: 1929 THROUGH MAY 2009

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI)decreased $143.8 billion, or 1.3 percent, in June, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $41.4 billion, or 0.4 percent. In May, personal income increased $155.1 billion, or 1.3 percent, DPI increased $168.7 billion, or 1.6 percent, and PCE increased $9.0 billion, or 0.1 percent, based on revised estimates.

Labels:

Personal income and outlays

Pre-market - August 4, 2009

Futures down this morning. Not sure why.

DJIA INDEX 9,197.00 -51.00

S&P 500 994.20 -6.50

NASDAQ 100 1,615.75 -11.00

Gold 959 3 0.31%

Oil 70.59 -0.97 -1.36%

Today's economic calendar:

ICSC-Goldman Store Sales 7:45 AM ET

Personal Income and Outlays 8:30 AM ET

Redbook 8:55 AM ET

Pending Home Sales Index 10:00 AM ET

4-Week Bill Auction 1:00 PM ET

Almost 300 earning reports

Market wrap - Monday - but a day late - 7:30AM

We broke and finished above the sentimental level of 1000 on the S&P, and 2000 on the NASDAQ - green shoots everywhere

Dow 9,287 115 1.25%

Nasdaq 2,009 30 1.52%

S&P 500 1,003 15 1.53%

Gold 959 3 0.31%

No price on oil, I didn't see it when the market closed.

Today by sector: Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Monday, August 3, 2009

SEC charges BofA over false statements in Merrill buy - 1:00 PM

UPDATE - 1:52 - More from MarketWatch

BofA pays $33 million SEC penalty for Merrill deal's bonuses

The charges are in relation to the institution's controversial acquisition of Merrill

WASHINGTON (MarketWatch) -- Bank of America Corp. agreed to a $33 million settlement with the Securities and Exchange Commission, which said the mega-bank made "materially false and misleading statements" to shareholders about billions in bonuses paid to Merrill Lynch executives before completing its controversial acquisition of the brokerage firm.

"The SEC alleges that in proxy materials soliciting the votes of shareholders on the proposed acquisition of Merrill, Bank of America stated that Merrill had agreed that it would not pay year-end performance bonuses or other discretionary compensation to its executives prior to the closing of the merger without Bank of America's consent," the SEC wrote.

"In fact, Bank of America had already contractually authorized Merrill to pay up to $5.8 billion in discretionary bonuses to Merrill executives for 2008."

According to the SEC's complaint, Bank of America /quotes/comstock/13*!bac/quotes/nls/bac (BAC 15.31, +0.52, +3.52%) said in a November, 2008, joint proxy statement for the acquisition that Merrill said it would not pay year-end bonuses to top executives before closing without Bank of America's consent.

"The disclosures in the proxy statement were rendered materially false and misleading by the existence of the prior undisclosed agreement allowing Merrill to pay billions of dollars in bonuses for 2008," the SEC said.

The SEC charges come after Federal Reserve Chairman Ben Bernanke, Bank of America Chief Executive Ken Lewis and former Treasury Secretary Henry Paulson have received a barrage of criticism from lawmakers over the past couple months.

Paulson and Bernanke have recently responded to a wide-variety of concerns expressed by lawmakers, ranging from criticism that they ordered Bank of America Chief Executive Ken Lewis to go through with the Merrill Lynch acquisition against his will, to questions why they didn't oust the bank's management and board upon providing government assistance.

SEC charges BofA over false statements in Merrill buy - Reuters (Reuters) - Bank of America Corp was charged by the SEC on Monday with making "materially false and misleading statements" in the Merrill Lynch acquisition, court documents said. * SEC says Bank of America said Merrill "had agreed not to pay year-end performance bonuses" before the closing of the merger but that no such agreement had been reached- court documents * SEC says Bank of America had agreed to pay up to $5.8 billion in Merrill bonuses, contrary to statements in merger agreement- court documents * SEC says bank of America falsely claimed that Merrill had agreed not to pay performance bonuses before closing of merger- court documents * SEC seeks injunction barring Bank of America executives from breaking securities laws and seeks fine

What about Bernanke and Paulson?

SEC charges BofA over false statements in Merrill buy - Reuters (Reuters) - Bank of America Corp was charged by the SEC on Monday with making "materially false and misleading statements" in the Merrill Lynch acquisition, court documents said. * SEC says Bank of America said Merrill "had agreed not to pay year-end performance bonuses" before the closing of the merger but that no such agreement had been reached- court documents * SEC says Bank of America had agreed to pay up to $5.8 billion in Merrill bonuses, contrary to statements in merger agreement- court documents * SEC says bank of America falsely claimed that Merrill had agreed not to pay performance bonuses before closing of merger- court documents * SEC seeks injunction barring Bank of America executives from breaking securities laws and seeks fine

What about Bernanke and Paulson?

Labels:

BAC,

Ben Bernanke,

Hank Paulson,

Ken Lewis,

SEC

Construction spending - 10:10AM

Full report here

JUNE 2009 CONSTRUCTION AT $965.7 BILLION ANNUAL RATE

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2009 was estimated at a seasonally adjusted annual rate of $965.7 billion, 0.3 percent (±1.4%)* above the revised May estimate

of $963.2 billion. The June figure is 10.2 percent (±1.8%) below the June 2008 estimate of $1,075.6 billion.

During the first 6 months of this year, construction spending amounted to $455.6 billion, 11.4 percent (±1.3%) below the $514.4 billion for the same period in 2008.

PRIVATE CONSTRUCTION

Spending on private construction was at a seasonally adjusted annual rate of $643.9 billion, 0.1 percent (±1.1%)* below the revised May estimate of $644.8 billion. Residential construction was at a seasonally adjusted annual rate of $246.1

billion in June, 0.5 percent (±1.3%)* above the revised May estimate of $244.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $397.9 billion in June, 0.5 percent (±1.1%)* below the revised May estimate of

$400.0 billion.

PUBLIC CONSTRUCTION

In June, the estimated seasonally adjusted annual rate of public construction spending was $321.7 billion, 1.0 percent (±2.4%)* above the revised May estimate of $318.5 billion. Educational construction was at a seasonally adjusted annual

rate of $91.0 billion, 0.4 percent (±3.7%)* above the revised May estimate of $90.7 billion. Highway construction was at a seasonally adjusted annual rate of $81.5 billion, 0.2 percent (±7.0%)* above the revised May estimate of $81.3 billion.

Labels:

Construction spending - June

ISM report - 10:05 AM

Full report here

New Orders and Production Growing

Employment and Inventories Contracting

Supplier Deliveries Slower

(Tempe, Arizona) — Economic activity in the manufacturing sector failed to grow in July for the 18th consecutive month, while the overall economy grew for the third consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The decline in manufacturing was slower in July when compared to June, as the more leading components of the PMI — the New Orders and Production Indexes — rose significantly above 50 percent, thus setting an expectation for future growth in the sector. The Employment and Inventories Indexes are still contracting, but the rate is slowing and they are moving in the right direction. It is also worth noting that the New Export Orders Index shows growth following nine consecutive months of decline, suggesting that the global economy is recovering. Overall, it would be difficult to convince many manufacturers that we are on the brink of recovery, but the data suggests that we will see growth in the third quarter if the trends continue."

PERFORMANCE BY INDUSTRY

Six of the 18 manufacturing industries reported growth in July. These industries — listed in order — are: Nonmetallic Mineral Products; Paper Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Transportation Equipment; and Chemical Products. The 10 industries reporting contraction in July — listed in order — are: Machinery; Plastics & Rubber Products; Wood Products; Textile Mills; Miscellaneous Manufacturing; Furniture & Related Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Fabricated Metal Products; and Primary Metals.

WHAT RESPONDENTS ARE SAYING ...

* "[There is concern about] overall health of strategic suppliers — continue to see new suppliers filing Chapter 7 or 11, posing significant risk to supply chain." (Machinery)

* "We believe our inventories are now at the bottom of this cycle, driving stronger demand for raw materials." (Paper Products)

* "While our aftermarket business has improved slightly, we are still awaiting an increase in OEM demand." (Transportation Equipment)

* "No stimulus for manufacturing." (Fabricated Metal Products)

* "Looking at another round of shutdowns to align supply with projected demands." (Nonmetallic Mineral Products)

Labels:

ISM

Pre-market - August 3 - 2009

Looks like the market likes August, another rocket ready to take off. Futures up large as we wait for the open:

DJIA INDEX 9,209.00 83.00

S&P 500 994.20 9.80

NASDAQ 100 1,619.75 17.75

Gold 956 19 1.97%

Oil 71.28 +1.88 +2.71%

Today's economic calendar:

Motor Vehicle Sales - throughout the day

ISM Mfg Index 10:00 AM ET

Construction Spending 10:00 AM ET

4-Week Bill Announcement 11:00 AM ET

3-Month Bill Auction 1:00 PM ET

6-Month Bill Auction 1:00 PM ET

Well over 100 companies report earnings today

Subscribe to:

Comments (Atom)