Friday, June 12, 2009

Pre-market - Friday, June 12,2009

Futures down slightly this morning:

DJIA INDEX 8,675.00 -24.00

S&P 500 935.00 -3.20 938.20

NASDAQ 100 1,487.00 -4.00

Gold 962 +7 0.76%

Oil 71.34 -1.38 -1.90%

Economic calendar today:

Import and Export Prices 8:30 AM ET

Consumer Sentiment 9:55 AM ET

Earnings reports today:

DUCK Duckwall-ALCO Stores Inc. - Services

MSB Mesabi Trust - Financial

Thursday, June 11, 2009

Market wrap - 4:10PM

Dow 8,801.45 +62.43 (0.71%)

S&P 500 944.56 +5.41 (0.58%)

Nasdaq 1,862.37 +9.29 (0.50%)

Gold 962 +7 +0.77%

Oil 72.58 +1.35 1.90%

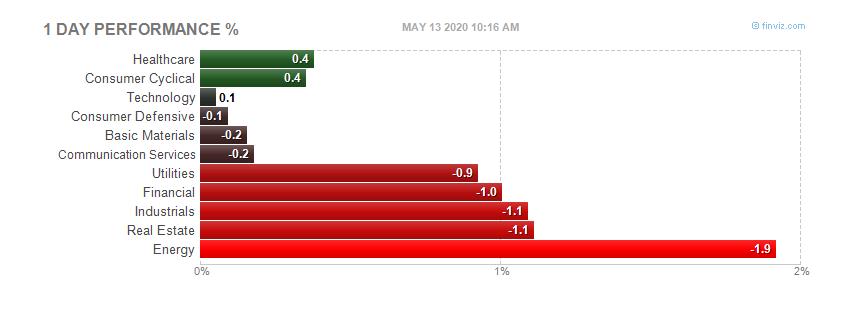

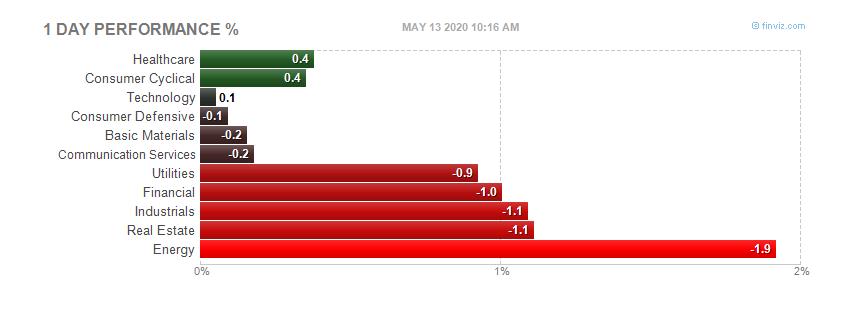

Today's leaders by sector:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Retail sales - Update 8:45AM

Full report here.

ADVANCE MONTHLY SALES FOR RETAIL TRADE AND FOOD SERVICES

MAY 2009

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $340.0 billion, an increase of 0.5 percent (±0.5%)* from the previous month, but 9.6 percent (±0.7%) below May 2008. Total sales for the March through May 2009 period were down 9.7 percent (±0.5%) from the same period a year ago. The March to April 2009 percent change was revised from -0.4 percent (±0.5%)* to -0.2 percent (±0.2%)*.

Retail trade sales were up 0.5 percent (±0.7%)* from April 2009, but 10.8 percent (±0.7%) below last year. Gasoline stations sales were down 33.8 percent (±1.5%) from May 2008 and motor vehicle and parts dealers sales were down 19.6 percent (±2.3%) from last year.

The advance estimates are based on a subsample of the Census Bureau's full retail and food services sample. A stratified random sampling method is used to select approximately 5,000 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms. Responding firms account for approximately 65% of the MARTS dollar volume estimate. For an explanation of the measures of sampling variability included in this report, please see the Reliability of Estimates section on the last page of this publication.

Labels:

June 11 release,

Retail Sales

Jobless claims - Update 8:40AM

Full report here.

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

SEASONALLY ADJUSTED DATA

In the week ending June 6, the advance figure for seasonally adjusted initial claims was 601,000, a decrease of 24,000 from the previous week's revised figure of 625,000. The 4-week moving average was 621,750, a decrease of 10,500 from the previous week's revised average of 632,250.

The advance seasonally adjusted insured unemployment rate was 5.1 percent for the week ending May 30, unchanged from the prior week's revised rate of 5.1 percent.

The advance number for seasonally adjusted insured unemployment during the week ending May 30 was 6,816,000, an increase of 59,000 from the preceding week's revised level of 6,757,000. The 4-week moving average was 6,750,500, an increase of 57,250 from the preceding week's revised average of 6,693,250.

The fiscal year-to-date average for seasonally adjusted insured unemployment for all programs is 5.238 million.

Labels:

Jobless claims

Pre-market, Thursday, June 11,2009

Futures up a little this morning

DJIA INDEX 8,768.00 +14.00

S&P 500 942.50 +2.00

NASDAQ 100 1,499.25 +3.50

Gold 955 0 0.00%

Oil 72.02 +0.69 +0.97%

Economic indicators for Thursday:

Retail Sales 8:30 AM ET

Jobless Claims 8:30 AM ET

RBC CASH Index 9:00 AM ET

Business Inventories 10:00 AM ET

EIA Natural Gas Report 10:30 AM ET

3-Month Bill Announcement 11:00 AM ET

6-Month Bill Announcement 11:00 AM ET

30-Yr Bond Auction 1:00 PM ET

Earnings reports for today (before open):

Today after close:

Today after close:

Today after close:

Today after close:

Wednesday, June 10, 2009

Beige Book report from the FED - Update 2:10PM

Full report here.

Summary

Prepared at the Federal Reserve Bank of Cleveland based on information collected on or before June 1, 2009. This document summarizes comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials.

Reports from the twelve Federal Reserve District Banks indicate that economic conditions remained weak or deteriorated further during the period from mid-April through May. However, five of the Districts noted that the downward trend is showing signs of moderating. Further, contacts from several Districts said that their expectations have improved, though they do not see a substantial increase in economic activity through the end of the year.

Manufacturing activity declined or remained at a low level across most Districts. However, several Districts also reported that the outlook by manufacturers has improved somewhat. Demand for nonfinancial services contracted across Districts reporting on this segment. Retail spending remained soft as consumers focused on purchasing less expensive necessities and shied away from buying luxury goods. New car purchases remained depressed, with several Districts indicating that tight credit conditions were hampering auto sales. Travel and tourism activity also declined. A number of Districts reported an uptick in home sales, and many said that new home construction appeared to have stabilized at very low levels. Vacancy rates for commercial properties were rising in many parts of the country, while developers are finding financing for new commercial projects increasingly difficult to obtain. Most Districts reported that overall lending activity was stable or weak, but with mixed results across loan categories. Credit conditions remained stringent or tightened further. Energy activity continued to weaken across most Districts, and demand for natural resources remained depressed. Planting and growing conditions varied across Districts as did agricultural input costs.

Labor market conditions continued to be weak across the country, with wages generally remaining flat or falling. Two Districts also mentioned employers' plans to scale back employee benefit programs. The Atlanta, Chicago, and St. Louis Districts reported that some state and local governments faced hiring freezes or outright job cuts. While manufacturing employment levels remained low, some Districts saw signs that job losses may be moderating. With few exceptions, Districts reported that prices at all stages of production were generally flat or falling. The notable exception to the downward pressure on prices was the widely-reported increase in oil prices.

Labels:

Beige book,

May

Crude oil report - 10:30AM

Crude inventories fall 4.4 million barrels: EIA

Gasoline inventories fall 1.6 million barrels: EIA

Distillate inventories fall 300,000 barrels

I'll post the link to the report when it becomes available.

Labels:

Weekly crude oil report

Purchase Applications Remain Steady, Refinance Applications Continue to Fall in Latest MBA Weekly Survey - Update 9:50

Purchase Applications Remain Steady, Refinance Applications Continue to Fall in Latest MBA Weekly Survey - Full link here

WASHINGTON, D.C. (June 10, 2009) — The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending June 5, 2009. The Market Composite Index, a measure of mortgage loan application volume, was 611.0, a decrease of 7.2 percent on a seasonally adjusted basis from 658.7 one week earlier. On an unadjusted basis, the Index increased 15.7 percent compared with the previous week and increased 7.6 percent compared with the same week one year earlier.

The Refinance Index decreased 11.8 percent to 2605.7 from 2953.6 the previous week and the seasonally adjusted Purchase Index increased 1.1 percent to 270.7 from 267.7 one week earlier.

The four week moving average for the seasonally adjusted Market Index is down 8.7 percent. The four week moving average is up 0.5 percent for the Purchase Index, while this average is down 12.2 percent for the Refinance Index.

The refinance share of mortgage activity decreased to 59.4 percent of total applications from 62.4 percent the previous week. This is the lowest the refinance share has been since November 2008. The adjustable-rate mortgage (ARM) share of activity increased to 3.4 percent from 3.0 percent of total applications from the previous week.

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.57 percent from 5.25 percent, with points increasing to 1.09 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 15-year fixed-rate mortgages increased to 5.10 percent from 4.80 percent, with points decreasing to 1.04 from 1.10 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for one-year ARMs increased to 6.75 percent from 6.61 percent, with points decreasing to 0.10 from 0.15 (including the origination fee) for 80 percent LTV loans.

**SPECIAL NOTES**

The survey covers more than 50 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

Labels:

Mortgage applications

Goldman Sachs says; Update - 9:40

IOSCO-RPT-Goldman CEO sees long recession - Reuters

Wed Jun 10, 2009 9:07am EDT

TEL AVIV, June 10 (Reuters) - Goldman Sachs CEO Lloyd Blankfein said on Wednesday he believed a current upturn in world markets was probably not a full recovery from crisis and said he expected a further long recession.

"I think it's going to be a long proctracted recession," he told an international regulators conference in Tel Aviv.

Addressing a current upturn in markets, he said: "There is no reason to think this is it ... So many things have to be sorted out. Why would this be the recovery?

"The chances are it's not." (Tel Aviv newsroom)

So, Blankfein from Goldman Sachs, the same bastards that has helped run the price of oil up to 71 dollars a barrel now, and the 140 dollars a year ago, is saying the recession will be long protracted recession. Why? And why are you saying this now? Not that I disagree, but this is common knowledge for anyone that doesn't listen to the "green shooters" on CNBC or the MSM. But why now would Blankfein say this, like he has any credibility to begin with. Did your trading desks decide its time to go SHORT Lloyd?

So, Blankfein from Goldman Sachs, the same bastards that has helped run the price of oil up to 71 dollars a barrel now, and the 140 dollars a year ago, is saying the recession will be long protracted recession. Why? And why are you saying this now? Not that I disagree, but this is common knowledge for anyone that doesn't listen to the "green shooters" on CNBC or the MSM. But why now would Blankfein say this, like he has any credibility to begin with. Did your trading desks decide its time to go SHORT Lloyd?

Market headlines - Update 9:10AM

Rising U.S. mortgage rates sap loan applications - Reuters

U.S. trade gap widens on softening exports - Reuters

Stocks, U.S. Futures, Commodities Gain; Dollar, Treasuries Fall - Bloomberg

Earning $200,000 a Year, Paying No Taxes: Chart of Day - Bloomberg

Citi finalizes U.S. exchange, sets rights offer - MarketWatch

Oil tops $71 after large drop in U.S. crude stocks - Reuters

Pre-market - Wednesday, June 9,2009

Futures up big at 7:10AM

DJIA INDEX 8,855.00 113.00

S&P 500 953.30 13.70

NASDAQ 100 1,516.00 15.25

Gold 955 +2 0.23%

Oil 71.26 +1.25 1.79%

Economic calendar for Wednesday:

MBA Purchase Applications 7:00 AM ET

Charles Evans Speaks 8:00 AM ET

International Trade 8:30 AM ET

Quarterly Services Survey 10:00 AM ET

EIA Petroleum Status Report 10:30 AM ET

10-Yr Note Auction 1:00 PM ET

Beige Book 2:00 PM ET

Treasury Budget 2:00 PM ET

Earnings reports today:

Before market opens in BOLD

Before market opens in BOLD

Before market opens in BOLD

Before market opens in BOLD

Tuesday, June 9, 2009

Pre-market - Tuesday, June 9, 2009

Futures about flat before open today. The big news on TV is the banks (some) repaying the TARP money.

DJIA INDEX 8,734.00 -25.00

S&P 500 936.60 -2.20

NASDAQ 100 1,489.00 -1.50

Gold 953 -10 -1.05%

Oil 68.99 +0.90 +1.32%

Economic reports for Tuesday:

ICSC-Goldman Store Sales 7:45 AM ET

Redbook 8:55 AM ET

Wholesale Trade 10:00 AM ET

4-Week Bill Auction 1:00 PM ET

3-Yr Note Auction 1:00 PM ET

Earnings reports:

Bold indicates before market opens.

Bold indicates before market opens.

Bold indicates before market opens.

Bold indicates before market opens.

Monday, June 8, 2009

Market wrap - 4:10PM

What a rally! Incredible, but then again, we've seen this before.

Dow 8,764.57 +1.44 (0.02%)

S&P 500 939.12 -0.97 (-0.10%)

Nasdaq 1,842.40 -7.02 (-0.38%)

Gold 953 -10 -1.05%

Oil 68.65 -0.35 -0.51%

Today's action by sector:

Led by the financials - who would have guessed it?

Today's heatmap:

Led by the financials - who would have guessed it?

Today's heatmap:

The market opened down today, then proceeded to go down most of the day. About 12:30 was the low of the day. At that time, the market trended upward, but not a solid or very bullish type run. Volume was on pace to be the lowest of the year. Until about 2:30 - then we had liftoff. We've seen this before so I guess we shouldn't be surprised. Here is today's action in the S&P 500.

Led by the financials - who would have guessed it?

Today's heatmap:

Led by the financials - who would have guessed it?

Today's heatmap:

The market opened down today, then proceeded to go down most of the day. About 12:30 was the low of the day. At that time, the market trended upward, but not a solid or very bullish type run. Volume was on pace to be the lowest of the year. Until about 2:30 - then we had liftoff. We've seen this before so I guess we shouldn't be surprised. Here is today's action in the S&P 500.

Say what? - What did he just say? - Update - 1:40PM

Steve Grasso on CNCB just said the following (paraphrased):

"The market is always setup to hurt the most people."

While being interviewed by the shrills on CNBC, as the market is down today, Steve Grasso, a floor general and always a "buy, buy, buy" kind of guy said the line above. Incredible!

Even Dennis Kneale questioned what he said. If they post the video I will post it. At least someone admits this casino now known as a market.

About 40 seconds into this segment listen to what Grasso said. Yep, that's what I thought he said.

Economic calendar this week

Economic calendar for the week:

Monday:

4-Week Bill Announcement 11:00 AM ET

3-Month Bill Auction 1:00 PM ET

6-Month Bill Auction 1:00 PM ET

Tuesday:

ICSC-Goldman Store Sales 7:45 AM ET

Redbook 8:55 AM ET

Wholesale Trade 10:00 AM ET

4-Week Bill Auction 1:00 PM ET

3-Yr Note Auction 1:00 PM ET

Wednesday:

MBA Purchase Applications 7:00 AM ET

Charles Evans Speaks 8:00 AM ET

International Trade 8:30 AM ET

Quarterly Services Survey 10:00 AM ET

EIA Petroleum Status Report 10:30 AM ET

10-Yr Note Auction 1:00 PM ET

Beige Book 2:00 PM ET

Treasury Budget 2:00 PM ET

Thursday:

Retail Sales 8:30 AM ET

Jobless Claims 8:30 AM ET

RBC CASH Index 9:00 AM ET

Business Inventories 10:00 AM ET

EIA Natural Gas Report 10:30 AM ET

3-Month Bill Announcement 11:00 AM ET

6-Month Bill Announcement 11:00 AM ET

30-Yr Bond Auction 1:00 PM ET

Friday:

Import and Export Prices 8:30 AM ET

Consumer Sentiment 9:55 AM ET

Keep an eye on those auctions I have bolded. The bond market auctions could become very critical to how the market moves this week.

Pre-market - Monday, June 8, 2009

Futures pointing to to a lower open today:

DJIA INDEX 8,681.00 -81.00

S&P 500 931.30 -9.20

NASDAQ 100 1,480.00 -15.00

Gold 949 -20 -2.01%

Oil 67.59 -0.86 -1.26%

Economic calendar for today:

4-Week Bill Announcement 11:00 AM ET

3-Month Bill Auction 1:00 PM ET

6-Month Bill Auction 1:00 PM ET

Earnings reports today:

BKRS reports before open, the rest after.

BKRS reports before open, the rest after.

BKRS reports before open, the rest after.

BKRS reports before open, the rest after.

Subscribe to:

Comments (Atom)