I haven't noticed Jeff Macke on CNBC lately. I wonder if this had anything to do with it?

That was from last Tuesday, the 16th, best I can tell, and I haven't seen him since. What's up with that?

I was a fan of Fast Money, didn't buy into all of their trades, but an entertaining show for someone who likes to hear traders. Macke was kind of a loudmouth but for the most part, I thought he told it like it was. Dylan Ratigan was the same way. Both could be loud, rude, and self righteous, but they seemed to ask better questions than the other poodles on the show.

I don't know what the rant Macke was about, but talking to Dennis Kneale might do that. Either he had a really bad day, or he wanted to, well, get canned? It seems to this blogger CNBC would like more poodles than pit bulls. They don't want people asking the tough questions, nor telling it like it is. It's all about cheering the market higher and kissing the bankster's ass.

From time to time I post a video of someone telling it like it is. Santelli, Macke, Ratigan, and I used to say Mark Haines, gave us the straight information we wanted in a business channel. Mark seems to be getting a bit "poodlish" but he's been doing this a long time, so I'll give him a pass. Those are the people who carry the water, borrowing a phrase from Santelli. The rest are actors, even though Ratigan could qualify as one.

I wonder if Macke finally had too much, and left the building. Could the anchor's be pressured to cheerlead, NOT ask the tough questions, slapped when they are too critical about government, or are down right told to lie to people? Not telling us is the same as lying in my book. Granted, there is a line where politics and financial news crosses the border, but to go looking for it when it fits some agenda, then to censor it at another, is pathetic. I don't read Macke or Ratigan as toe the company line of BS sort of people.

I know, they say "there is no shame on Wall Street" but you would sure hope there is a little bit. Just guessing and hoping.

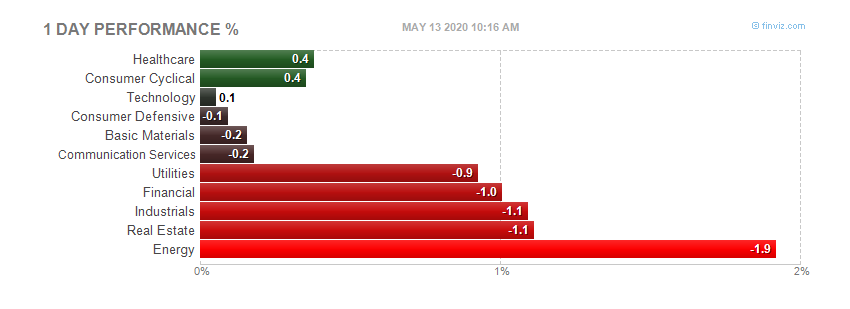

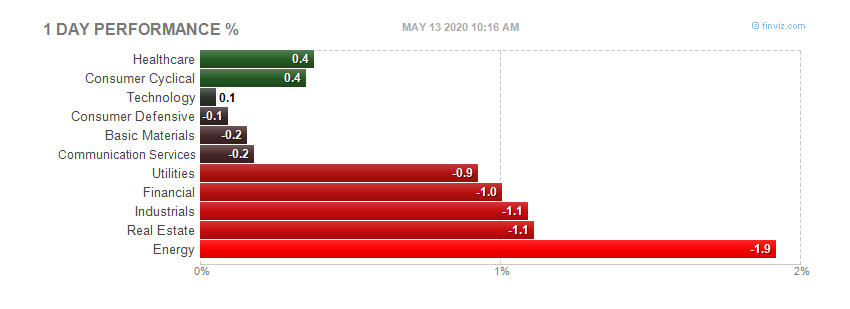

The financials only came in second today? I'm surprised to say the least.

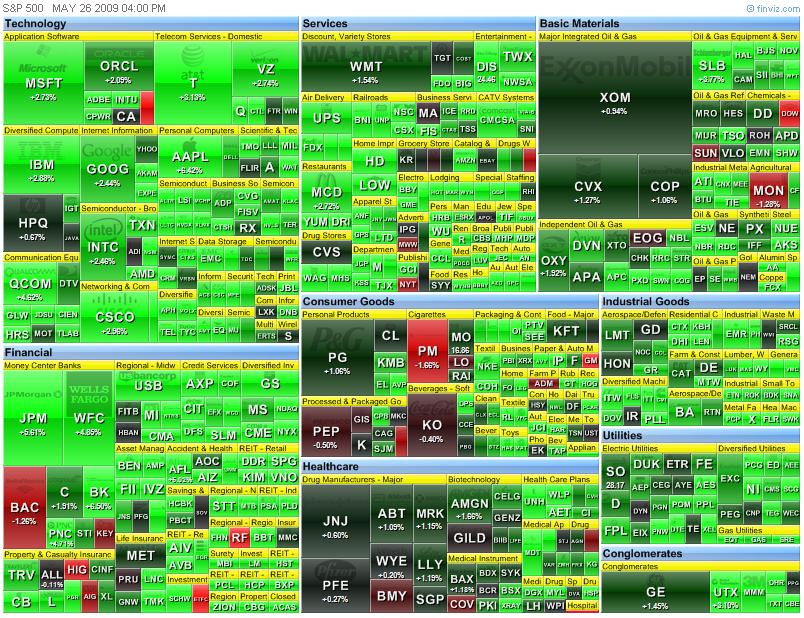

Today's heatmap:

The financials only came in second today? I'm surprised to say the least.

Today's heatmap:

Gold 980 +17 +1.78%

Oil 66.38 1.23 1.89%

Gold 980 +17 +1.78%

Oil 66.38 1.23 1.89%